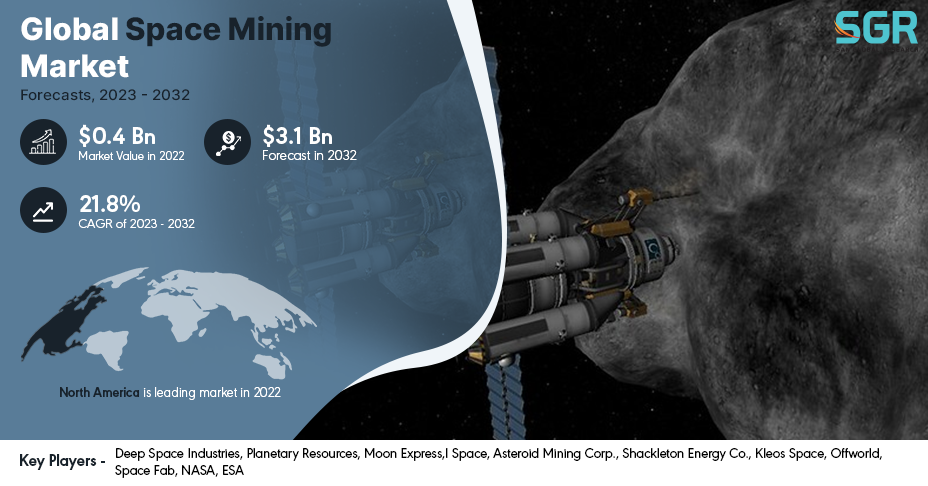

Global Space Mining Market is estimated to be worth USD 0.4 Billion in 2022 and is projected to grow at a CAGR of 21.8% market size of market and the forecast period is 2023 to 2032.

The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Phase, by Type of Asteroid and by region/country.

_Bar.jpg)

The global space mining market has witnessed significant growth and development in recent years, propelled by the increasing interest in exploiting extraterrestrial resources. With advancements in space exploration technologies and a growing recognition of the potential economic benefits, numerous private companies and government entities are actively exploring opportunities in space mining. The market encompasses a wide range of activities, including prospecting, exploration, and extraction of valuable minerals and resources from celestial bodies such as asteroids, the Moon, and even Mars. Key drivers for the market include the rising demand for rare earth elements, precious metals, and water in space, which can be utilized for in-situ resource utilization (ISRU) to support future space missions. As technology continues to advance and regulatory frameworks evolve, the global space mining market is poised for further expansion, offering new frontiers for investment and collaboration between space agencies, private enterprises, and research institutions worldwide. Challenges, including technical feasibility, legal considerations, and international cooperation, will need to be addressed to ensure sustainable and responsible growth in this emerging sector.

.jpg)

Region wise Comparison:

The North American space mining market is at the forefront of global developments, with the United States playing a leading role in advancing space mining technologies and policies. NASA and private companies are actively engaged in prospecting asteroids for valuable resources, such as platinum and rare earth elements. Robust private sector participation, regulatory clarity, and substantial investment contribute to the region's dominance in this emerging market.

Europe is positioning itself as a key player in the global space mining arena, with countries like Luxembourg spearheading initiatives to foster space resource utilization. The European Space Agency (ESA) and private enterprises are investing in research and development, focusing on technologies for sustainable resource extraction. Collaborative efforts among European nations contribute to the region's competitiveness in space mining endeavors.

.jpg)

The Asia Pacific region is witnessing significant growth in the space mining market, driven by the space ambitions of countries like China and Japan. Both government space agencies and private companies are investing in lunar and asteroid exploration missions, aiming to secure access to precious metals and minerals. The Asia Pacific market is characterized by a combination of government-backed initiatives and active private sector involvement.

Latin America is increasingly exploring opportunities in space mining, leveraging its rich resource base and geographical advantages. Countries like Brazil are investing in space programs that include the prospecting and extraction of minerals from celestial bodies. Latin America's engagement in the space mining market is poised to expand, driven by a combination of national space agencies and private enterprises seeking to tap into extraterrestrial resources.

The Middle East has entered the space mining arena, with countries like the United Arab Emirates making strides in space exploration. Governments in the region are investing in research and development to harness the potential of asteroids and other celestial bodies. The Middle East's interest in space mining reflects a broader strategy of diversification and technological advancement. Africa is emerging as a participant in the global space mining market, with nations like South Africa expressing interest in space resource utilization. Collaborative efforts among African countries and partnerships with international entities contribute to the region's growing presence in space mining initiatives. Africa's involvement presents opportunities for economic development and technological innovation.

Australia, with its advanced space capabilities and vast uninhabited land, is actively contributing to the global space mining landscape. The Australian government and private companies are investing in research and development for prospecting and extracting resources from asteroids and celestial bodies. Australia's strategic location and technological expertise position it as a significant player in the evolving space mining market.

.jpg)

Segmentation:

The Global Space Mining Market is segmented by Phase, by Type of Asteroid and by region/country.

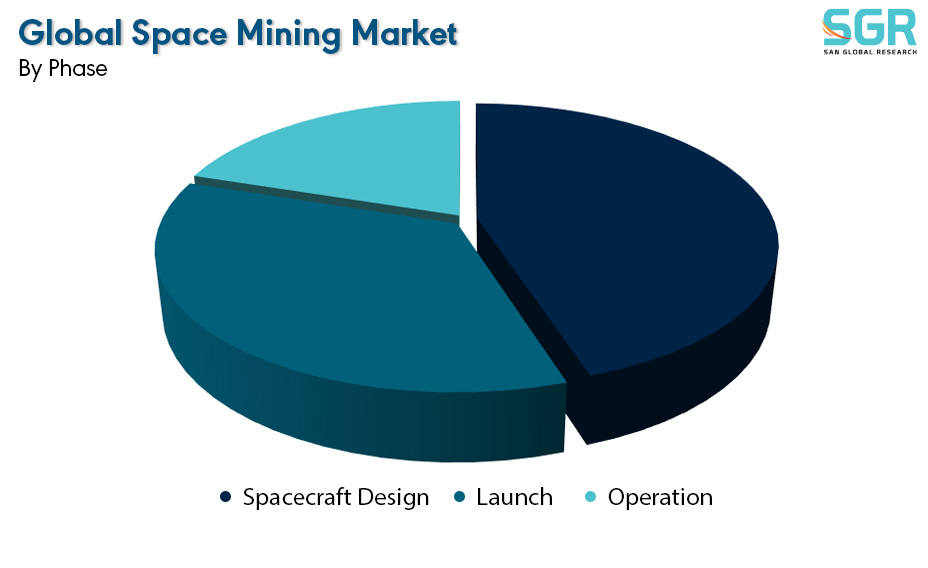

By Phase:

Based on the Phase, the Global Space Mining Market is bifurcated into Spacecraft Design, Launch & Operation – where Spacecraft Design is dominating and ahead in terms of share.

The spacecraft designs employed in the global space mining market are diverse and tailored to the unique challenges of extracting resources from celestial bodies. Robotic spacecraft, equipped with advanced sensors and autonomous systems, are commonly used for prospecting and exploration missions. These spacecraft are capable of navigating the vastness of space, identifying potential resource-rich targets, and collecting valuable data for further analysis. For resource extraction, specialized mining spacecraft are designed with tools and mechanisms to retrieve materials from asteroids or planetary surfaces. Innovative technologies such as autonomous drilling systems, robotic arms, and on-board processing units are integrated into these spacecraft to enable efficient extraction and processing of valuable minerals.

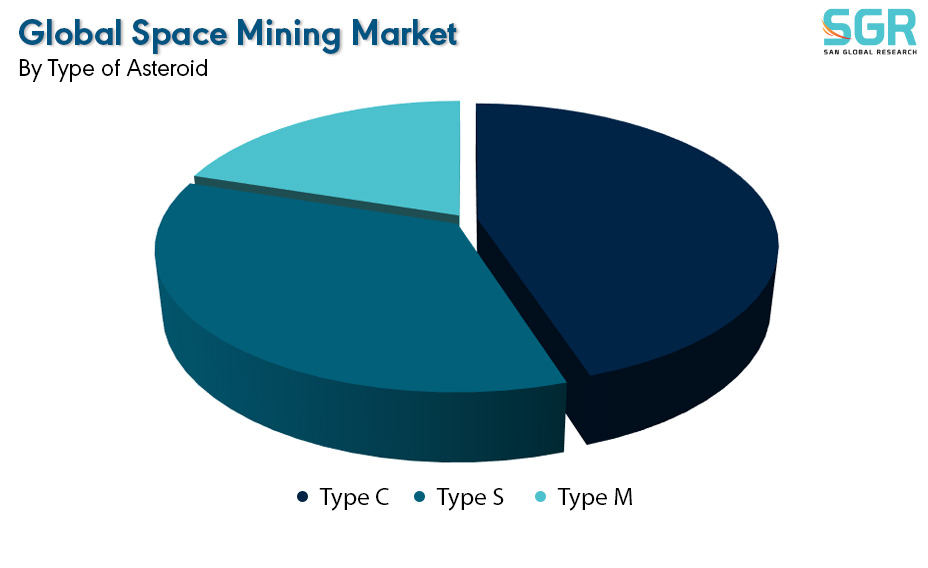

By Type of Asteroid:

Based on the Type of Asteroid, the Global Space Mining Market is bifurcated into Type C, Type S & Type M – where Type S is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global Space Mining Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Space Mining Market include

• Deep Space Industries

• Planetary Resources

• Moon Express

• I Space

• Asteroid Mining Corp.

• Shackleton Energy Co.

• Kleos Space

• Offworld

• Space Fab

• NASA

• ESA

Drivers:

Growing sector across the globe

The global space mining market is propelled by a confluence of drivers that collectively underscore the burgeoning interest in exploiting extraterrestrial resources. One of the primary drivers is the increasing demand for rare earth elements, precious metals, and other valuable resources critical for technological advancements on Earth. As terrestrial reserves become more challenging to access and deplete, the prospect of harnessing resources from asteroids, the Moon, and other celestial bodies becomes increasingly attractive. Additionally, the development of advanced space exploration technologies and the emergence of private companies dedicated to space mining contribute to the market's growth. The concept of in-situ resource utilization (ISRU) further drives the space mining market, as the ability to generate essential resources in space, such as water and oxygen, can significantly reduce the costs and logistical challenges of future space missions. As governments, research institutions, and private enterprises continue to invest in space exploration and technology, the global space mining market is poised for sustained expansion, offering new economic opportunities and possibilities for scientific discovery beyond Earth's boundaries.

Opportunity:

Evolving Market

The global space mining market presents a myriad of opportunities that span technological innovation, economic growth, and scientific exploration. One prominent opportunity lies in the potential for vast untapped resources in space, including rare minerals, precious metals, and water. The extraction and utilization of these resources hold the promise of addressing resource scarcity challenges on Earth and fueling technological advancements. As private companies increasingly invest in space mining ventures, there are opportunities for collaboration between the public and private sectors, fostering a robust and dynamic space economy. In addition, the development of advanced robotics, artificial intelligence, and other cutting-edge technologies for space mining operations opens up new frontiers in engineering and innovation. Furthermore, the establishment of international partnerships and collaborative initiatives can lead to the creation of a regulatory framework that ensures responsible and sustainable space mining practices. Overall, the global space mining market offers a frontier of opportunities that extend beyond immediate economic gains, encompassing scientific discovery, technological progress, and the potential for a new era of human expansion into space.

| Report Attribute | Details |

| Market Value in 2022 | 0.4 Billion |

| Forecast in 2032 | 2.72 Billion |

| CAGR | CAGR of 21.8% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Phase, By Type of Asteroid |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | Deep Space Industries, Planetary Resources, Moon Express,I Space, Asteroid Mining Corp., Shackleton Energy Co., Kleos Space, Offworld, Space Fab, NASA, ESA |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355