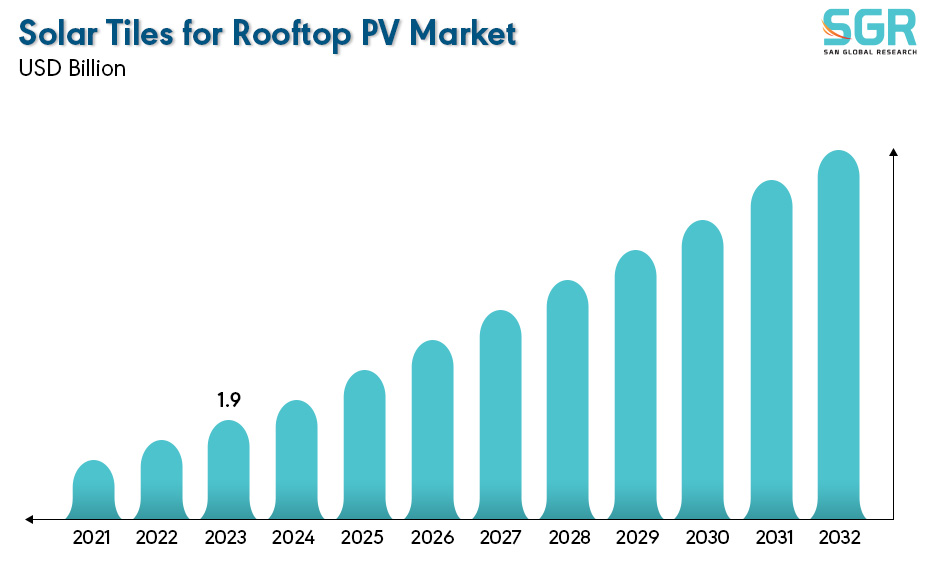

Solar Tiles for Rooftop PV Market is estimated to be worth USD 1.9 Billion in 2023 and is projected to grow at a CAGR of 15.7% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by sales channel, by application and by region/country.

Solar tiles refer to solar photovoltaic (PV) panels that are designed to resemble traditional roofing materials like asphalt shingles, slate, or clay tiles. These solar tiles are integrated into the structure of a building and serve a dual purpose: they act as both roofing material and energy generators.

The rooftop PV (Photovoltaic) market refers to the market for solar energy systems installed on rooftops. This market encompasses various technologies, including solar panels, solar tiles, and associated components such as inverters and energy storage systems. The adoption of solar tiles in the rooftop PV market is driven by factors such as increasing awareness of renewable energy, government incentives, and a growing interest in sustainable building practices. The idea behind solar tiles is to make solar power more aesthetically pleasing and seamlessly integrate renewable energy into residential and commercial buildings. Unlike traditional solar panels, which are mounted on top of an existing roof, solar tiles replace conventional roofing materials, providing a more integrated and visually appealing solution.

.jpg)

Region wise Comparison:

Government incentives, such as tax credits or rebates for renewable energy installations, has significantly influence the demand for solar tiles in the North America Region. Policies supporting clean energy and sustainable practices at the federal, state, or local levels can drive adoption.

Many European countries have set ambitious renewable energy targets to reduce carbon emissions and combat climate change. Policies and incentives supporting solar energy, including solar tiles, may contribute to increased demand. European countries often have stringent building codes and standards that encourage or mandate the integration of renewable energy solutions in new constructions. This can contribute to the demand for solar tiles as an aesthetically pleasing and integrated solution.

.jpg)

Some countries in the Asia-Pacific region face challenges related to energy access, and there is a growing demand for reliable and sustainable energy sources. This demand could drive interest in solar technologies as a viable solution, including solar tiles. Rapid urbanization and a surge in construction activities in many Asia-Pacific countries has lead to increased demand for innovative and integrated building solutions. Solar tiles, which combine roofing and energy generation, can be attractive in such contexts.

The MEA region is known for its high solar irradiance, making it well-suited for solar energy generation. Increase in solar tiles demand is a way to harness this abundant sunlight for both residential and commercial applications.

.jpg)

Segmentation:

The Solar Tiles for Rooftop PV Market is segmented by type, by application and by region/country.

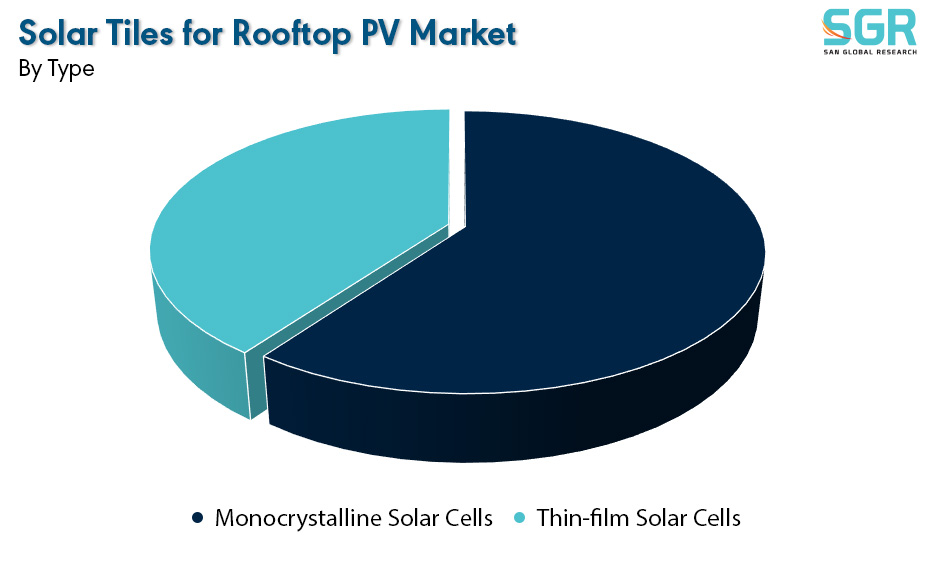

By Type:

Based on the type, the Solar Tiles for Rooftop PV Market is bifurcated into Monocrystalline Solar Cells and Thin-film Solar Cells – where Monocrystalline Solar Cells is dominating and ahead in terms of share.

Monocrystalline solar cells are a type of photovoltaic cell used in solar panels, including those integrated into solar tiles for rooftop PV (photovoltaic) systems. These solar cells are made from a single crystal structure, usually of high-purity silicon. Monocrystalline solar cells are known for their high efficiency in converting sunlight into electricity. The single-crystal structure allows for a more organized arrangement of atoms, resulting in fewer defects and higher energy conversion efficiency. This makes monocrystalline solar cells suitable for applications where space is limited, such as rooftop installations. Monocrystalline solar cells tend to have a higher power output per square foot compared to other types of solar cells. This space efficiency is crucial for rooftop PV installations where the available roof space may be limited.

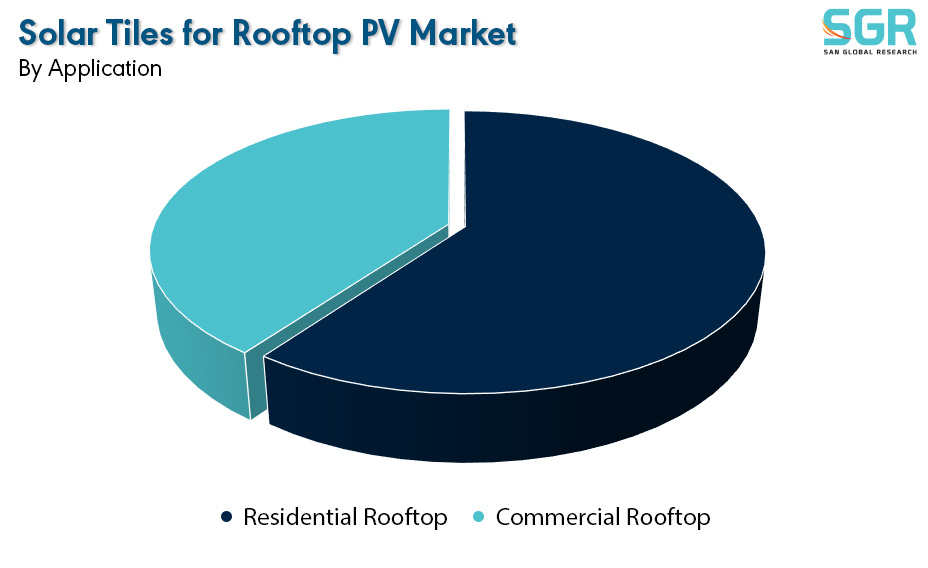

By Application:

Based on the application, the Solar Tiles for Rooftop PV Market is bifurcated into Residential Rooftop and Commercial Rooftop – where Residential Rooftop is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Solar Tiles for Rooftop PV Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Solar Tiles for Rooftop PV Market include

• GAF Energy

• Tesla

• CertainTeed

• Midsummer

• GB-Sol

• Luma Solar

• SolteQ

• SunTegra

• Shinto

• Solarmass Energy

• SunStyle

• Autarq

• Ennogie

• Dyaqua

• Meyer Burger

Drivers:

Aesthetic Integration

Solar tiles are designed to seamlessly integrate with traditional roofing materials, providing an aesthetically pleasing solution for homeowners and businesses. The ability to mimic the appearance of conventional roofing materials makes solar tiles more visually appealing compared to traditional solar panels. Aesthetic integration in solar cells, particularly when incorporated into solar tiles for rooftop PV (photovoltaic) systems, refers to the seamless blending of solar technology with the overall design and appearance of a building. This aesthetic consideration is crucial for widespread adoption, as it addresses concerns about the visual impact of solar installations on architectural aesthetics. Solar tiles are typically made from materials like tempered glass, polymers, or other durable materials. The design aims to balance functionality with visual appeal, ensuring that the solar cells are effective while maintaining the desired aesthetic. Solar tiles are becoming more widely available as advancements in technology continue. Several companies are actively developing and marketing solar tile products, and the market is expected to grow as more homeowners and businesses seek sustainable energy solutions.

Opportunity:

Rising Demand for Sustainable Construction

Growing awareness of environmental issues and a heightened focus on sustainable construction practices create opportunities for solar tiles. These tiles offer an integrated solution that aligns with green building initiatives. Sustainable construction includes features that enhance a building's resilience and self-sufficiency. Solar tiles contribute to energy independence by generating electricity on-site, providing a reliable power source and potentially reducing dependence on external energy grids. Solar tiles offer an aesthetically pleasing alternative to traditional solar panels. As sustainability becomes a key consideration in construction, the ability to seamlessly integrate solar technology into the building's design without compromising its appearance is attractive to architects and homeowners. Many sustainable construction projects aim to achieve high levels of energy efficiency and may pursue certifications such as LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method). Solar tiles contribute to energy efficiency goals and can be a valuable component in meeting certification requirements. Governments and local authorities worldwide are increasingly promoting renewable energy adoption through incentives, rebates, and regulations. In some regions, building codes may even require or incentivize the incorporation of solar energy systems, including solar tiles, in new construction projects.

| Report Attribute | Details |

| Market Value in 2022 | 1.7 Billion |

| Forecast in 2032 | 7.3 Billion |

| CAGR | CAGR of 15.70% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • GAF Energy, • Tesla, • CertainTeed, • Midsummer, • GB-Sol, • Luma Solar, • SolteQ, • SunTegra, • Shinto, • Solarmass Energy, • SunStyle, • Autarq, • Ennogie, • Dyaqua, • Meyer Burger |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355