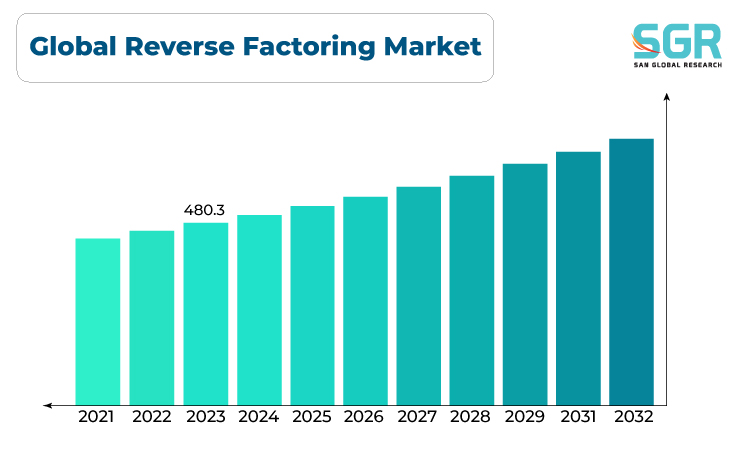

Global Reverse Factoring Market is estimated to be worth USD 480.3 Billion in 2022 and is projected to grow at a CAGR of 9.8% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by category, by financial Institution, by end use and region/country.

The global reverse factoring market plays a pivotal role in facilitating supply chain finance, offering a financial solution that enables businesses to optimize working capital by extending payment terms to suppliers while providing early payment options through a financial institution. This market has seen significant growth due to its ability to improve cash flow for both buyers and suppliers within supply chains. Reverse factoring, also known as supply chain finance, allows large corporations or buyers to leverage their creditworthiness to secure lower-cost financing for their suppliers. This arrangement provides suppliers with the option to receive payments earlier than the agreed-upon terms, helping them manage cash flow effectively. The market's growth is propelled by the increasing demand for working capital optimization, particularly among companies looking to enhance their liquidity and maintain healthy supplier relationships. The global reverse factoring market continues to evolve, driven by technological advancements, the integration of digital platforms, and the expansion of supply chain networks, catering to the financial needs of businesses across various industries and sectors.

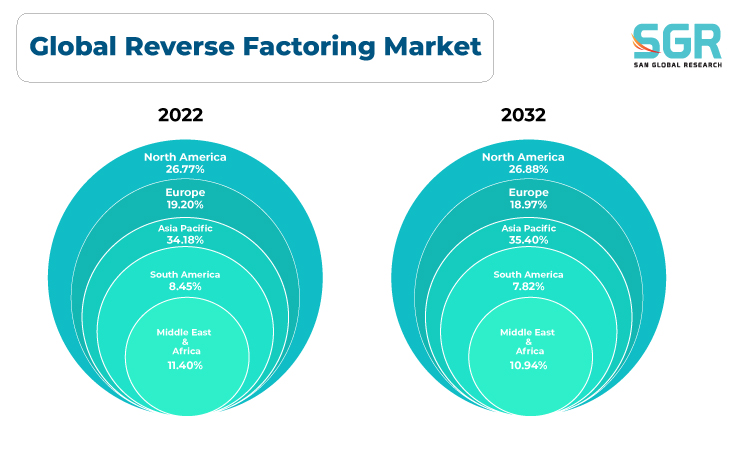

Region Wise Comparison:

North America serves as a prominent market for reverse factoring solutions, particularly in the United States, where large corporations often utilize supply chain finance to optimize working capital. The region's developed financial infrastructure and a high volume of trade contribute to the growth of the reverse factoring market.

Europe showcases a robust reverse factoring market, with countries like Germany, the United Kingdom, and France leading the adoption of supply chain finance solutions. The region's well-established manufacturing sectors and extensive trade networks drive the demand for working capital optimization through reverse factoring.

The Asia-Pacific region demonstrates a growing interest in supply chain finance and reverse factoring solutions, fueled by the region's thriving manufacturing hubs, especially in China, Japan, and South Korea. As these countries expand their trade relationships globally, the demand for financing options to optimize cash flow in supply chains rises.

Latin America's reverse factoring market is evolving, with countries like Brazil and Mexico witnessing increased adoption of supply chain finance solutions, particularly in industries like automotive, manufacturing, and agriculture. Economic growth and trade activities in the region contribute to the growing interest in working capital optimization.

Africa's market for reverse factoring is relatively nascent compared to other continents due to varying economic development levels and trade volumes. However, certain regions are exploring supply chain finance solutions to optimize cash flow in key industries, such as mining and agriculture.

Segmentation:

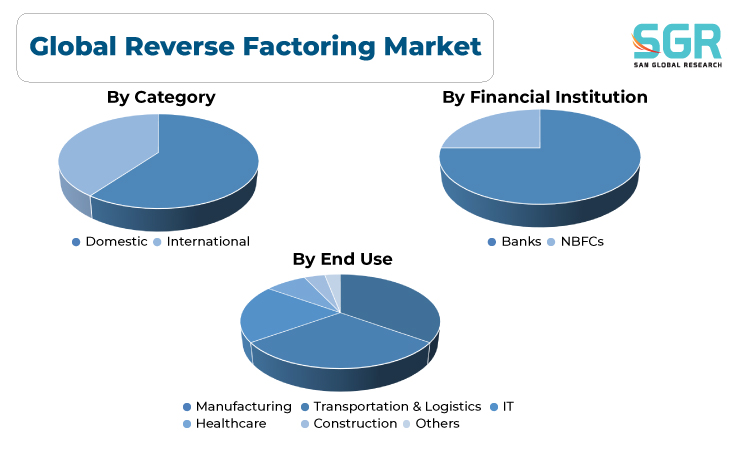

The Global Reverse Factoring Market is segmented by category, by financial Institution, by end use and region/country.

By Category:

- Based on the Category, the Global Reverse Factoring Market is bifurcated into Domestic & International – where the Domestic based is dominating and ahead in terms of share.

- The domestic type refers to the utilization of supply chain finance solutions within a country's borders, focusing on transactions occurring between entities within the same country. This aspect of reverse factoring involves facilitating payment terms between domestic buyers and suppliers, allowing businesses to optimize working capital by streamlining cash flows without necessarily involving international trade.

- Domestic reverse factoring aids in improving liquidity and cash management for companies by offering early payment options to suppliers while extending payment terms for buyers.

By Financial Institution:

- Based on the Financial Institutions, the Global Reverse Factoring Market is bifurcated into Banks & NBFCs – where Bank is dominating and ahead in terms of share.

By End Use:

- Based on the End Use, the Global Reverse Factoring Market is bifurcated into Manufacturing, Transportation & Logistics, IT, Healthcare, Construction and Others – where the Manufacturing is dominating and ahead of others in terms of share.

On the basis of region

- North America

- Europe

- Asia Pacific

- South America and

- Middle East and Africa

In 2022, North America is anticipated to dominate the Global Reverse Factoring Market with market revenue of XX USD Million with a registered CAGR of XX%.

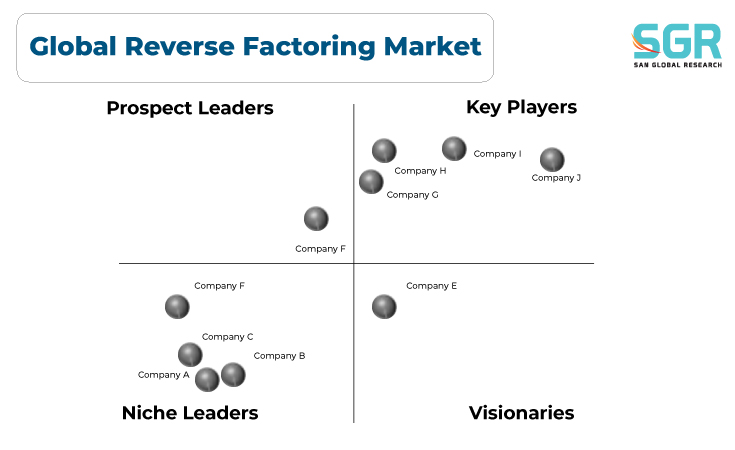

Key Players:

The key market players operating in the Global Reverse Factoring Market include

- ACCION

- BANCO BILBAO

- BARCLAYS

- CREDIT SUISSE

- DEUTSCHE BANK

- HSBC

- JPMC

- MITSUBISHI

- PRIME REVENUE

- VIVA CAPITAL

Drivers

Growing sector across the globe

The drivers shaping the global reverse factoring market reflect a convergence of factors impacting supply chain finance on an international scale. Firstly, the increasing complexity of global supply chains and trade networks has fueled the demand for efficient working capital management. Reverse factoring provides a mechanism for buyers to optimize their cash flow by extending payment terms while offering early payment options to suppliers, thus enhancing the liquidity and financial stability of businesses across borders. Secondly, the evolving regulatory landscape and supportive policies have encouraged the adoption of supply chain finance solutions globally, facilitating smoother transactions and fostering trust among participants in these financial arrangements. Additionally, technological advancements, especially in digital platforms and fintech solutions, have streamlined and democratized access to reverse factoring, making it more feasible for businesses of varying sizes and sectors. Moreover, the growing need for resilient and reliable supply chains, particularly in times of economic volatility or disruptions, drives the uptake of supply chain finance solutions like reverse factoring, ensuring the continuity and efficiency of international trade. Overall, these drivers collectively contribute to the sustained growth and evolution of the global reverse factoring market, addressing the intricate financial needs and challenges of businesses operating within the interconnected global economy.

Opportunity:

Evolving Market

The global reverse factoring market presents an array of compelling opportunities driven by evolving financial needs and the quest for enhanced supply chain efficiency. One significant opportunity lies in expanding the reach of supply chain finance solutions, particularly in emerging markets, where there's a growing need for working capital optimization and improved cash flow management within supply chains. As businesses seek to bolster their financial stability and maintain healthy relationships with suppliers, there's an opportunity to leverage reverse factoring to enhance liquidity and ensure a reliable flow of goods and services. Furthermore, technological innovations continue to offer opportunities for the advancement of digital platforms and fintech solutions, making reverse factoring more accessible and efficient for businesses across industries and geographies. The rise of sustainable finance and ESG (Environmental, Social, and Governance) initiatives also presents an opportunity to align supply chain finance solutions with sustainability goals, catering to the demands of ethically conscious businesses. Overall, the dynamic and evolving nature of global trade and financial ecosystems continues to unfold opportunities for innovative, inclusive, and resilient supply chain finance solutions like reverse factoring to optimize working capital and foster stronger partnerships throughout supply chains worldwide.

Description

Description

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355