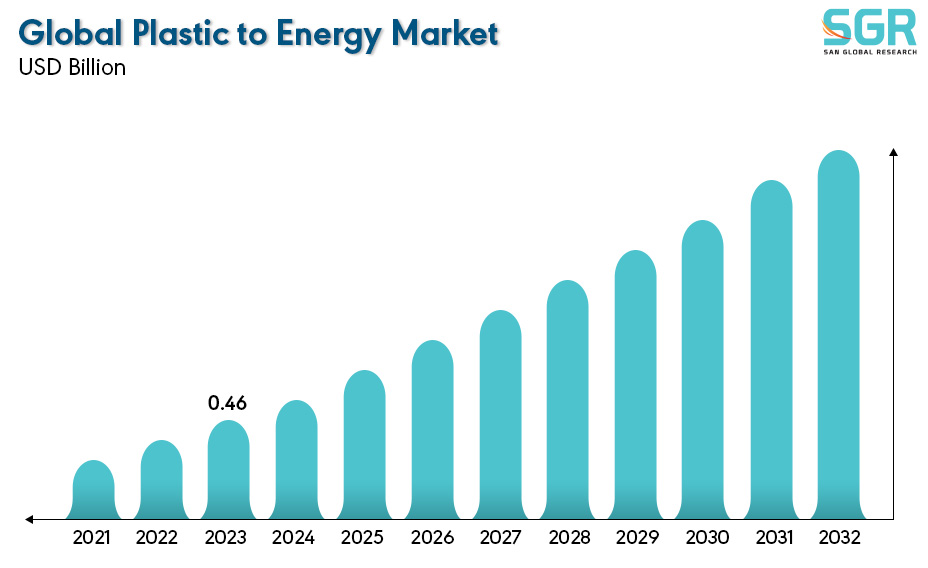

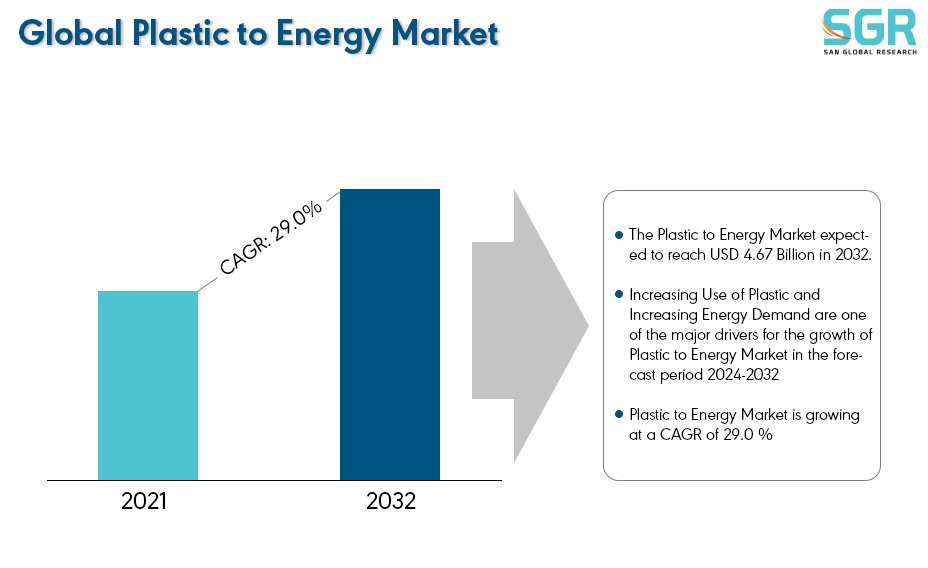

Plastic to Energy Market is estimated to be worth USD 0.46 Billion in 2023 and is projected to grow at a CAGR of 29.0 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Technology, by End Product and by region/country.

Plastic waste poses serious threats to the environment, leading to a decrease in soil nutrient effectiveness, agricultural production, and the emergence of ecological instability. Worldwide, synthetic plastic production has reached 400 million tons. More than 50% of this amount is disposed of in landfills or recycled, while over 15 million tons find their way into seas and oceans annually. Plastic waste enters the ocean through various avenues. Two-thirds of the waste originates from land-based sources, including litter left on beaches, washed down rivers and drains, and discarded in towns and cities. Industrial spills, poorly managed landfill sites, bins near the coast, and rubbish flushed down toilets also contribute to ocean pollution. The majority of these waste items consist of single-use plastics such as drink bottles, plastic bags, cotton bud sticks, sanitary items, and wet wipes.

In addressing the issue, fuel conversion from plastic waste is considered a promising strategy for disposal and energy utilization. Plastic wastes can be transformed into target fuels by adjusting the cracking of chemical bonds. Currently, numerous technologies for fuel conversion from plastic wastes have been reported, encompassing conventional pyrolysis, novel heat treatment, and advanced oxidation.

After reviewing the data shown below, it can be determined that the Europe region dominates the Plastic to Energy Market for the following reasons.

Europe is grappling with a substantial challenge concerning plastic waste, with only approximately 9% of the plastics ever produced being recycled and 12% incinerated, leaving a significant portion either still in use or improperly disposed of. In 2021, plastic production in Europe alone reached 57.2 million tons, with post-consumer recycled plastics and bio-based plastics constituting only a small percentage. Due to these factors, the market for plastic-to-energy is experiencing significant growth.

Incineration serves as a waste disposal method, but emissions from plastic incineration in the U.S. amounted to 5.9 million metric tons of carbon dioxide in 2015. Projections suggest that these emissions will increase to 49 million metric tons by 2030 and 91 million metric tons by 2050. In response to this challenge, the North American region is opting for the creation of energy from plastic, a move that is significantly boosting the Plastic to Energy market.

In the Middle East, effective waste management strategies have been put into practice, emphasizing the conversion of plastic waste into fuel. This method not only minimizes the volume of solid waste in landfills but is also anticipated to reduce CO2 emissions in Egypt resulting from plastic waste by around 8% in the initial year and 30% over the first five years. Additionally, it addresses the substantial demand for fossil fuel products. The carbon emissions associated with this innovative fuel are also 93% lower compared to those generated by traditional diesel and gasoline use. Also, Egypt boasts ten refineries that collectively generate 760,000 barrels of petroleum products per day. However, the consumption of petroleum products in Egypt has surpassed this output, reaching 1.2 million barrels. 35% of petroleum products in Egypt are imported, while the remaining 65% are locally produced. The cost of imported oil amounted to approximately $7 billion in 2019. Consequently, fuel derived from plastic waste would meet the energy demands of the transport sector, providing Egypt with a continuous and sustainable source of fuel. Due to these factors, there is a notable surge in the plastic-to-energy market.

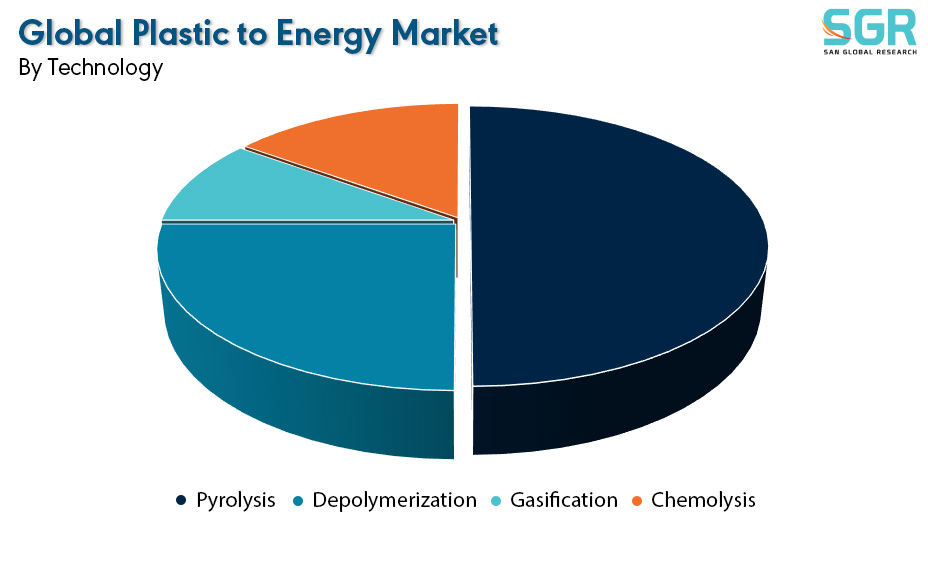

By Technology

Based on the Technology, the Plastic to Energy Market is bifurcated into Pyrolysis, Depolymerization, Gasification and Chemolysis – where Pyrolysis based technology is dominating and ahead in terms of share. Pyrolysis of waste plastic yields liquid crude oil, gas, char, and wax, with liquid oil being the most valuable product. This review places emphasis on the yields of pyrolysis products from both thermal and catalytic pyrolysis, as well as the factors influencing these yields. The use of AlCl3, can significantly enhance the quality of waste plastic pyrolytic oil (WPPO), reduce the time and energy consumption of the process, and facilitate the removal of contaminants from waste plastic which is basically a homogeneous catalyst. Due to these reasons, the pyrolysis segment within the technological category dominates in the plastic-to-energy market.

By End Product

Based on the End Product, the Plastic to Energy Market is bifurcated into Sulfur, Hydrogen, Crude Oil, Gas and Others– where Crude Oil based End Product is dominating and ahead in terms of share. The crude oil segment holds a dominant position within the end product segment of the plastic-to-energy market, owing to its extensive utilization across various industries. It is widely used in automobiles, power generators, ships, boilers, and construction vehicles and equipment. The versatility and compatibility of crude oil with existing infrastructure and machinery make it the preferred choice for fuel in diverse applications, thereby contributing to its market dominance.

Key Players

• Plastic2Oil

• JBI Inc.

• Envion

• RES Polyflow

• Green Envirotec Holdings LLC

• Beston (Henan) Machinery Co., Ltd.

| Report Attribute | Detail |

| Market Value in 2023 | 0.46 Billion |

| Forecast in 2032 | 4.67 Billion |

| CAGR | CAGR of 29% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Technology, By End Product |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Beston (Henan) Machinery Co., Ltd. • Green Envirotec Holdings LLC • RES Polyflow • Envion • JBI Inc. • Plastic2Oil |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355