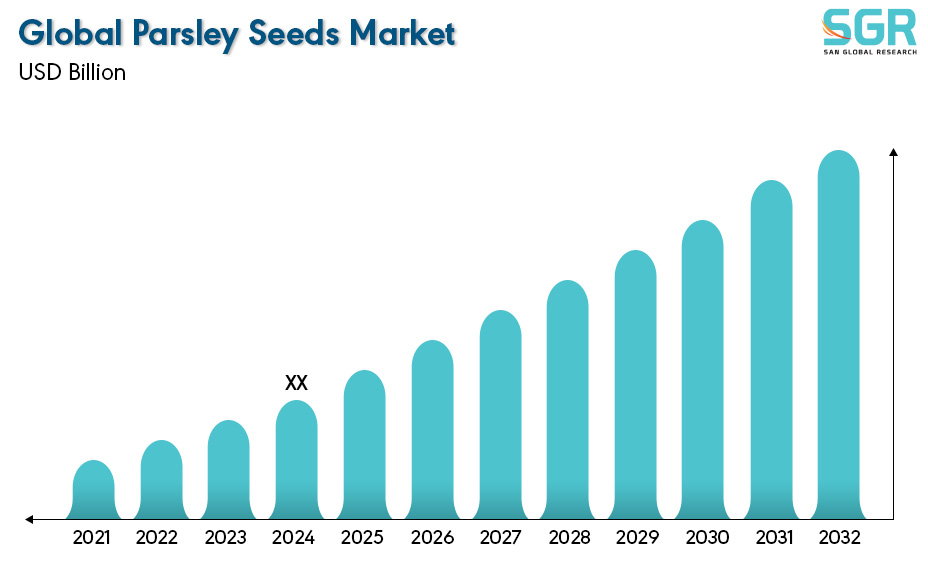

Global Parsley Seeds Market is estimated to be worth USD xx billion in 2024 and is projected to grow at a CAGR of xx% market size of market and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD million), for the market. The report segments the market and forecasts it by Source, By Species, By Application and by region/country.

Parsley is a popular flowering plant native to the central and eastern Mediterranean and a member of the Apiaceae family. There are two common types of parsley. Italian flat leaf parsley and French curly parsley. It is used in cooking in many countries, including the United States, Europe, and the Middle East. This herb is used in a variety of recipes, including salads, soups, and sauces. Parsley leaves are not only a great garnish for a variety of dishes, but they are also a source of essential nutrients, including calcium, magnesium, folate, potassium, and vitamins A, K, and C.

By Region, Europe has the largest share of market.

Europe indeed had a significant presence in the parsley seeds market. Countries like the Netherlands, Germany, and France were key players in parsley seed production and export. Europe's favorable climate for parsley cultivation, along with advanced agricultural practices and infrastructure, contributed to its dominance in the market. The European parsley seed market is expected to experience growth in the organic parsley seed market due to high consumer sensitivity and demand for organic products The main production countries are countries in Europe, parts of the Middle East, Canada and the United States, but the origin of the herb is in the Mediterranean. Germany and France are the largest producers of this herb.

Segmentation

By Application

Though in foods and beverages, parsley is widely used from Ancient times as a garnish, condiment, food, and flavoring the parsley seeds finds its application in various industry parsley is also used as a culinary herb. Parsley is the most widely cultivated herb in Europe, and the most-used herb in the United States. Pharmaceuticals industry has the largest share by Application Segment. The herb and seed are used medicinally for kidney and bladder problems, but has also been used for menstrual difficulties, digestive complaints and for arthritis, rheumatism, rickets and sciatica. It is said to stimulate hair growth, and help eliminate lice, as well as aiding in beauty treatments for broken capillaries, psoriasis and varicose veins. It is said, that it helps to regulate menstruation and maintains uterine health. Parsley Oil also gives relief from problems associated with menstruations, such as abdominal cramp and pain, nausea, and fatigue. This various wide scope of application in the industry resulted into the dominance of pharmaceuticals industry on parsley seeds market.

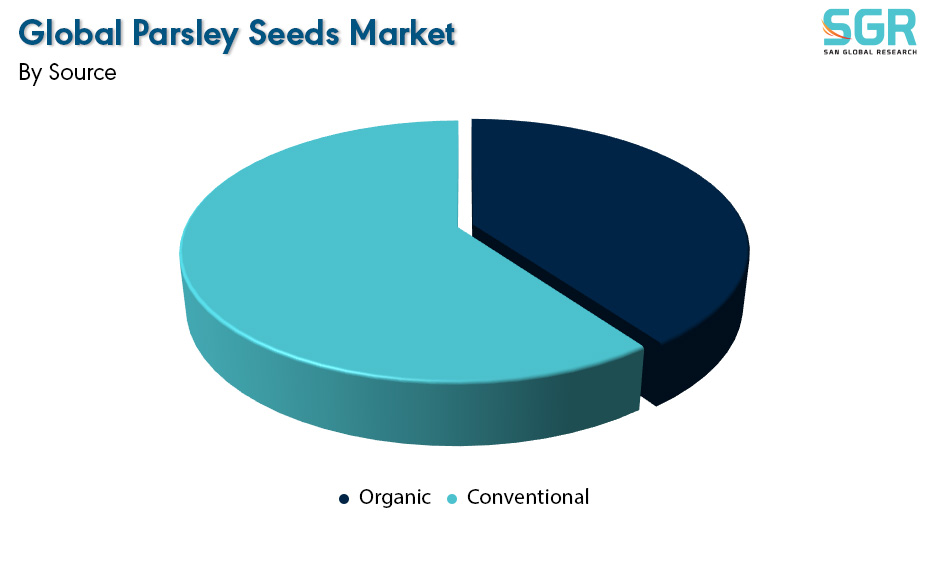

By Source

By source of seeds the market is bifurcated into Organic and conventional the organic segment is dominating the parsley seeds markets the trend of the market is changing from conventional method of farming to organic, in organic the produced is cultivated without chemical (for pesticides and insecticides ) this shift is the market is because of the increasing demand for organic produce the health concern of people is also the reason for the demand The increasing demand for organic produce is expected to boost the segment's growth. For instance, according to the Organic Trade Association, in 2021, organic food sales in the United States amounted to about 57.5 billion USD, which was 50.07 billion USD in 2019.

Driver

Burgeoning interest in home grown herbs.

Consumers are increasingly seeking fresh, flavorful ingredients and the satisfaction of cultivating their own food. Parsley, with its relatively easy germination and short growing season, is a perfect candidate for home gardens. This trend towards homegrown herbs fuels demand for high-quality parsley seeds, propelling market growth.

Opportunity

Application of parsley seed oil in the Personal Care.

In foods and beverages, parsley is widely used as a garnish, condiment, food, and flavoring but along with that Parsley seed finds its application in manufacturing of different pharma cuticles product for instance parsley seed oil is used as a fragrance in soaps, cosmetics, and perfumes. Parsley seeds are extensively used to extract parsley oil. The rising demand for parsley oil among the manufacturers is driving the demand for parsley seeds. The increasing demand for parsley oil is due to its anti-inflammatory and anti-microbial properties. The rise in the research of the medicinal benefits of parsley seeds and oils are also boosting the growth potential of the industry.

| Report Attribute | Details |

| Market Value in 2024 | XX Billion |

| Forecast in 2032 | XX Billion |

| CAGR | CAGR of xx% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Source, By Species, By Application and By region/country. |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Sage Garden, • Sustainable Seed, • Johnny's Selected Seeds, • Park Seed Wholesale, • Jensen Seeds • Atlee Burpee |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355