Report Overview

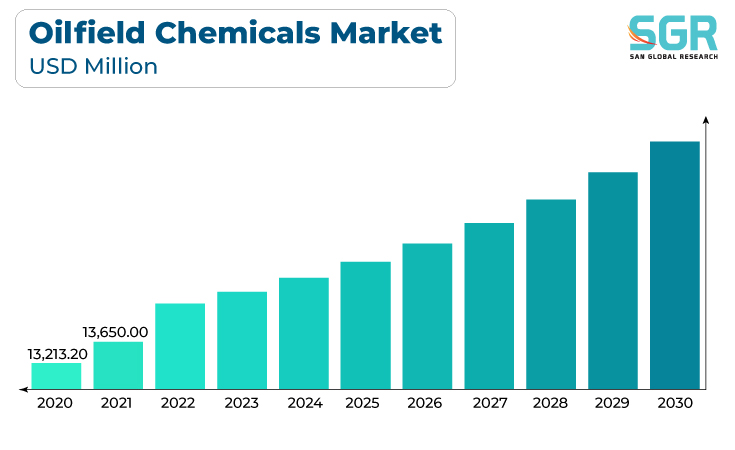

The oilfield chemicals market was valued at 14,117.62 million in 2022 and expected to grow at CAGR of 4.1% over forecast period.

The primary driver is the level of oil and gas exploration and production activities. Increased drilling and extraction operations globally drive the demand for chemicals to optimize production, enhance recovery rates, and mitigate challenges associated with oilfield operations. Advances in oilfield technologies necessitate the use of specialized chemicals to address new challenges and optimize processes. Enhanced oil recovery techniques, unconventional oil and gas extraction methods, and deepwater drilling all contribute to the need for innovative and advanced oilfield chemicals.

In addition, the growing global demand for energy, particularly oil and natural gas, stimulates increased exploration and production activities. This rise in demand creates a parallel demand for oilfield chemicals to ensure efficient and cost-effective extraction and processing.

Many oil and gas operations involve water, and water management is a critical aspect of the industry. Chemicals are used for water treatment, corrosion inhibition, and scale control in various processes, including hydraulic fracturing (fracking) and enhanced oil recovery methods.

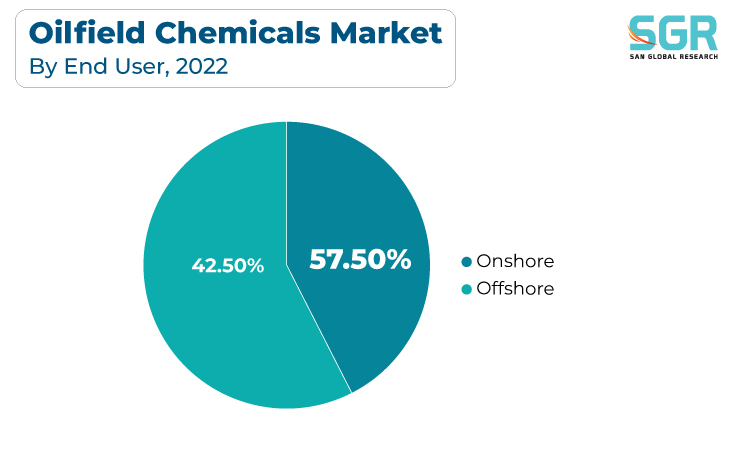

Location Outlook

Based on location, the oilfield chemicals market is segmented into onshore and offshore. Onshore segment accounted for largest share in 2022. The growth of the oilfields chemicals market is significantly influenced by the activities and requirements associated with onshore oilfield locations. Onshore oilfields, which are situated on land as opposed to offshore locations, contribute to the demand for a variety of chemicals used in different stages of oil and gas exploration, drilling, production, and processing.

Moreover, Onshore oilfields often witness high levels of exploration and drilling activities. The ongoing search for new oil reserves and the development of existing fields on land require the use of various chemicals, such as drilling fluids, corrosion inhibitors, and scale inhibitors, to optimize the drilling process and protect equipment.

Onshore oilfields often face water-related challenges, such as water flooding for enhanced oil recovery or the treatment of produced water. Chemicals are essential for water management, including the treatment of injection water and the control of issues like corrosion, scaling, and microbial growth.

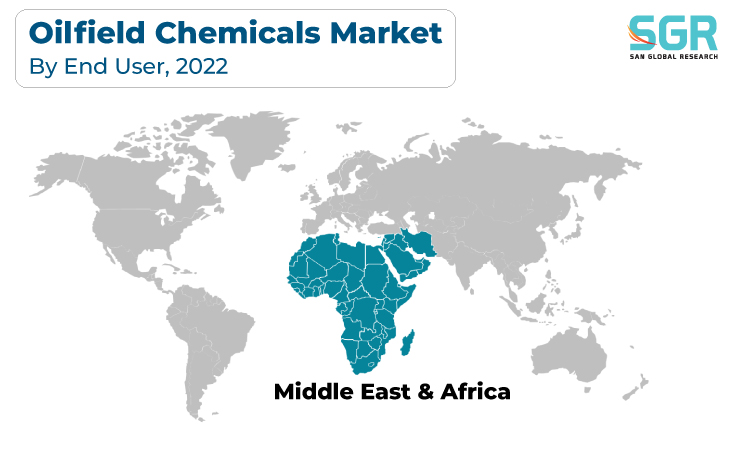

Regional Outlook

Middle East and Africa has emerged as leading market for oilfield chemicals market in 2022. Several key factors are driving the Middle East and Africa Oilfield chemicals Market such as the Middle East is home to some of the world's largest proven oil and gas reserves. The continuous exploration and extraction activities in countries like Saudi Arabia, the United Arab Emirates, Iraq, and Kuwait create a substantial demand for oilfield chemicals. These chemicals are essential for optimizing production, ensuring reservoir integrity, and addressing challenges associated with specific geological formations.

The Middle East witnesses a high intensity of exploration and drilling activities, both for conventional and unconventional hydrocarbon resources. This necessitates the use of a wide range of oilfield chemicals, including drilling muds, corrosion inhibitors, scale inhibitors, and enhanced oil recovery (EOR) chemicals to address the diverse challenges associated with different reservoir types.

Moreover, the region has been at the forefront of adopting advanced oil recovery techniques to maximize the extraction of hydrocarbons from existing reservoirs. This includes the use of chemicals such as surfactants, polymers, and alkali agents in enhanced oil recovery projects, contributing to the growth of the oilfield’s chemicals market.

Oilfield Chemicals Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 14,117.62 Million |

| Forecast in 2030 | USD 19,329.21 Million |

| CAGR | CAGR of 4.1% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product, By Application, By Location |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | BASF SE, Schlumberger Limited, Halliburton, Clariant, Dow Inc., Chevron Phillips Chemical Company, AkzoNobel, Kemira Oyj, Solvay S.A., SMC Global among Others |

Global Oilfield Chemicals Market, Report Segmentation

Oilfield Chemicals Market, By Product

- Demulsifiers

- Inhibitors

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

Oilfield Chemicals Market, By Application

- Drilling Fluid

- Production Chemicals

- Cementing

- Workover & Completion

Oilfield Chemicals Market, By Location

- Onshore

- Offshore

Oilfield Chemicals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355