Report Overview

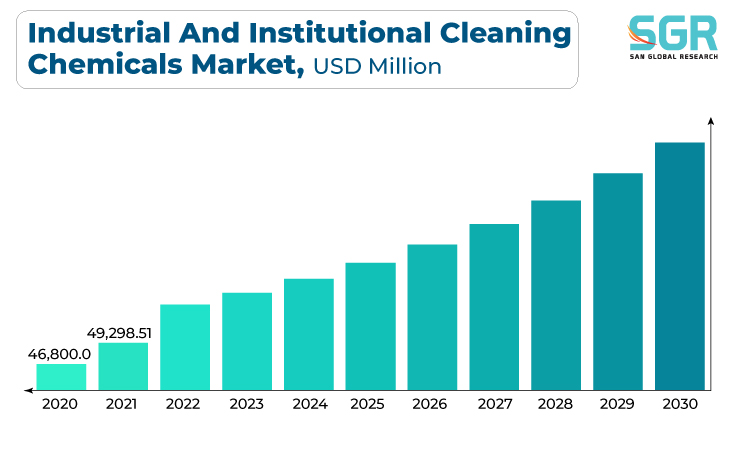

The industrial and institutional cleaning chemicals market was valued at 9,877.50 million in 2022 and expected to grow at CAGR of 5.6% over forecast period.

Stringent government regulations and environmental laws govern the production, labeling, and use of cleaning chemicals. Compliance with these regulations is crucial for manufacturers to avoid legal issues and maintain consumer trust which is major driving factor for the growth of industrial and institutional cleaning chemicals market.

Furthermore, increasing awareness of environmental issues has led to a demand for eco-friendly and sustainable cleaning solutions. Consumers, businesses, and governments are pushing for products with reduced environmental impact, such as biodegradable, non-toxic, and phosphate-free cleaners.

For instance-

In 2020, Proklean launched bio-friendly floor cleaners, liquid detergents for various industries such as leather, textile, paper and pulp processing.

Such type of product launches is fueling the growth of the market in recent days.

Moreover, the food and beverage industry are highly regulated to ensure food safety and quality. Cleaning and sanitation are fundamental to meet these standards. Cleaning chemicals are used to disinfect equipment, surfaces, and utensils to prevent contamination and maintain product quality are propelling the growth of the industrial and institutional cleaning chemicals market.

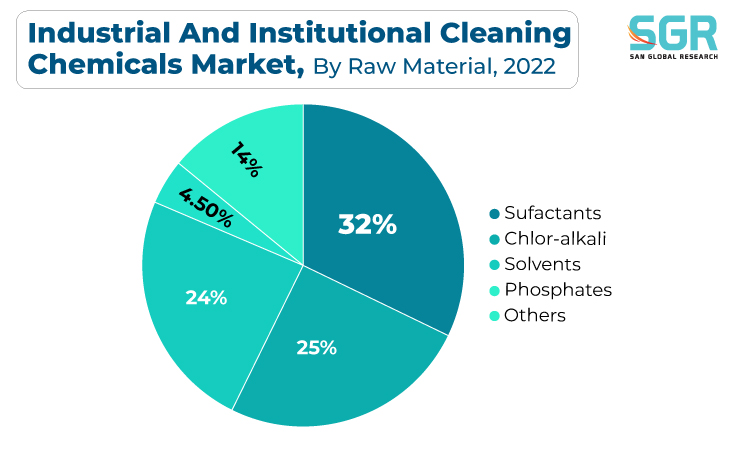

Raw Material Outlook

Based on raw material, the industrial and institutional cleaning chemicals market is segmented into chlor-alkali, surfactants, solvents, phosphates and others. Surfactants segment accounted for largest share in 2022. Surfactants are versatile chemical compounds have a significant impact on the effectiveness, safety, and versatility of cleaning products used in institutional settings. Surfactants are surface-active agents that reduce the surface tension of liquids. This property allows them to penetrate and break down dirt, grease, and grime more effectively. Cleaning products with surfactants are capable of lifting and suspending soils, making them easier to remove from surfaces. This improved cleaning power is a key factor for huge usage of surfactant in preparation of industrial and institutional cleaning chemicals.

Furthermore, Manufacturers are focusing on expansion for launch of various surfactants for of industrial and institutional cleaning processes which will boost the demand for surfactants in the coming years.

For instance,

In June 2022, BASF and Hannong Chemicals are planning to establish a production joint venture for the commercial production of non-ionic surfactants in Asia Pacific.

Regional Outlook

North America has emerged as leading market for industrial and institutional cleaning chemicals market in 2022. Several key factors are driving the North America industrial and institutional cleaning chemicals market such as North America, particularly the United States and Canada, has some of the most stringent regulatory standards regarding cleanliness, hygiene, and safety. These regulations drive the demand for high-quality cleaning chemicals that meet or exceed established standards. Compliance with regulations is especially critical in institutional settings like healthcare facilities and schools. Additionally, The COVID-19 pandemic has significantly increased awareness of the importance of cleanliness and hygiene. This heightened awareness has led to an increased focus on cleaning and sanitation in commercial and institutional spaces, boosting the demand for cleaning chemicals.

Industrial and Institutional Cleaning Chemicals Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 51,949.63 Million |

| Forecast in 2030 | USD 80,074.14 Million |

| CAGR | CAGR of 5.6% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Raw Material, By Product, By End Use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | BASF, DOW, EOC Group, P&G, Unilever, Ecolab, The Clorox Company, Henkel AG & Co. KGaA, 3M, and SOLVAY |

Global Industrial and institutional cleaning chemicals Market, Report Segmentation

Industrial and institutional cleaning chemicals Market, By Raw Material

- Chlor-alkali

- Surfactants

- Solvents

- Phosphates

- Other

Industrial and institutional cleaning chemicals Market, By Product

- General Purpose Cleaners,

- Disinfectants & sanitizers

- Laundry Care Products, Vehicle Wash Products, And Others

- Vehicle Wash Products

- Other

Industrial and institutional cleaning chemicals Market, By End Use

- Commercial

- Manufacturing

Industrial and institutional cleaning chemicals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355