Report Overview

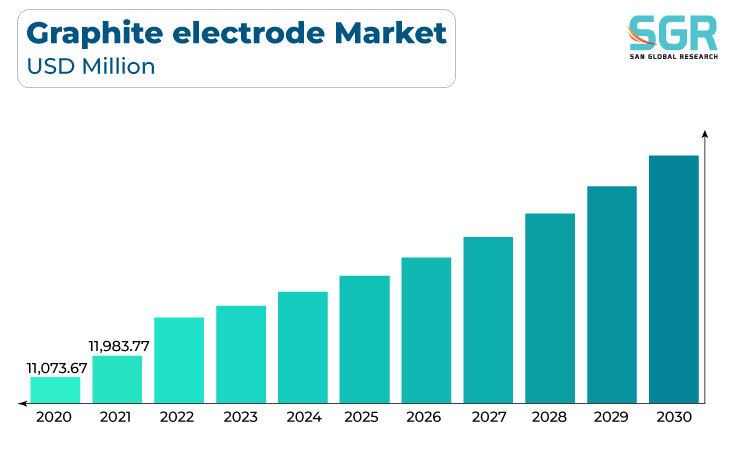

The graphite electrode market was valued at 11,983.77 million in 2022 and expected to grow at CAGR of 8.3% over forecast period.

The primary driver for the graphite electrode market is the demand from the steel industry. Graphite electrodes are essential in electric arc furnaces (EAFs), which are widely used in steel production. The shift towards electric arc furnace steelmaking, which is more energy-efficient and environmentally friendly compared to traditional methods, has increased the demand for graphite electrodes.

In addition, rising infrastructure development activities worldwide, including construction and industrial projects, contribute to increased demand for steel and, consequently, graphite electrodes. Furthermore, the automotive industry's growing demand for steel for manufacturing lightweight and high-strength components, as well as the trend toward electric vehicles, drives the need for graphite electrodes in steel production.

Investments in renewable energy projects, such as wind and hydropower, drive the demand for graphite electrodes in the production of specialty steel required for these projects.

Application Outlook

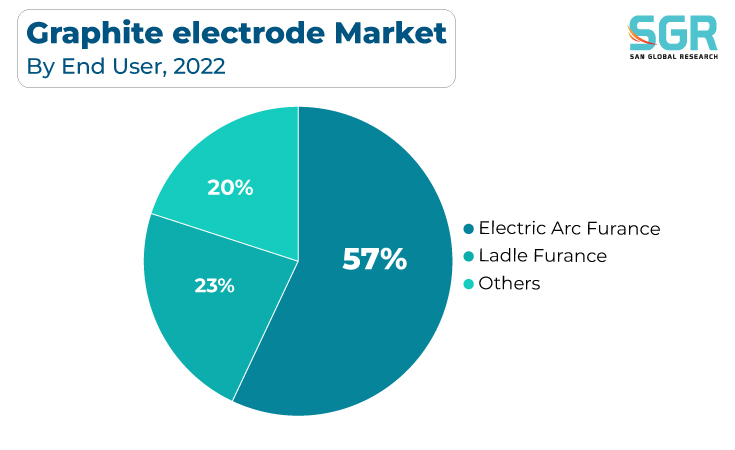

Based on application, the graphite electrode market is segmented into electric arc furnace, ladle furnace, others. Electric arc furnace segment accounted for largest share in 2022. Electric arc furnaces are used in the steelmaking process to melt scrap steel and other raw materials using an electric arc. Graphite electrodes play a crucial role in conducting the electric current required for this process. Furthermore, the global demand for steel continues to rise due to infrastructure development, construction projects, and industrialization. EAFs are a key component of steel production, and their increased use contributes to the growing demand for graphite electrodes.

Moreover, EAFs are known for their energy efficiency compared to traditional steelmaking methods. As the industry places a greater emphasis on reducing energy consumption and environmental impact, the adoption of EAFs is on the rise, leading to increased demand for graphite electrodes.

Regional Outlook

Asia-Pacific has emerged as leading market for graphite electrode market in 2022. Several key factors are driving the Europe graphite electrode market such as the automotive industry in Asia-Pacific is witnessing significant growth, contributing to the demand for steel and, subsequently, graphite electrodes. Graphite electrodes are essential in electric arc furnaces used for steelmaking in the automotive sector.

The ongoing industrialization in Asia-Pacific countries fuels the demand for steel across various industries, including manufacturing, machinery, and construction. This industrial growth propels the use of electric arc furnaces and, consequently, graphite electrodes. Asia-Pacific countries play a central role in the globalization of steel supply chains. This involves the movement of steel products across borders, impacting the demand for graphite electrodes in different regions. Thus, growth of the graphite electrode market in Asia-Pacific is closely linked to the region's dominant steel industry, industrialization, infrastructure development, and the adoption of advanced steelmaking technologies. As Asia-Pacific economies continue to expand, the demand for graphite electrodes is expected to remain strong.

Graphite Electrode Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 12,982.11 Million |

| Forecast in 2030 | USD 24,604.55 Million |

| CAGR | CAGR of 8.3% from 2023 to 2030 |

Base Year of forecast |

2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Electrode Grade, By Raw Material, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Graphite India Limited, HEG Limited, Showa Denko K.K., Tokai Carbon Co., Ltd., Fangda Carbon New Material Co., Ltd., GrafTech International Ltd., Nantong Yangzi Carbon Co., Ltd., SEC Carbon Limited, Sinosteel Jilin Carbon Co., Ltd., EPM Group among Others |

Global Graphite Electrode Market Report Segmentation

𝗚𝗿𝗮𝗽𝗵𝗶𝘁𝗲 𝗘𝗹𝗲𝗰𝘁𝗿𝗼𝗱𝗲 𝗠𝗮𝗿𝗸𝗲𝘁, 𝗕𝘆 𝗘𝗹𝗲𝗰𝘁𝗿𝗼𝗱𝗲 𝗚𝗿𝗮𝗱𝗲

- Ultra-High Power

- High Power

- Regular Power

𝗚𝗿𝗮𝗽𝗵𝗶𝘁𝗲 𝗘𝗹𝗲𝗰𝘁𝗿𝗼𝗱𝗲 𝗠𝗮𝗿𝗸𝗲𝘁, 𝗕𝘆 𝗥𝗮𝘄 𝗠𝗮𝘁𝗲𝗿𝗶𝗮𝗹

- Petroleum Coke

- Needle Coke

- Pitch Coke

- Coal Tar Pitch

- Others

𝗚𝗿𝗮𝗽𝗵𝗶𝘁𝗲 𝗘𝗹𝗲𝗰𝘁𝗿𝗼𝗱𝗲 𝗠𝗮𝗿𝗸𝗲𝘁, 𝗕𝘆 𝗔𝗽𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻

- Electric Arc Furnace

- Ladle Furnace

- Others

𝗚𝗿𝗮𝗽𝗵𝗶𝘁𝗲 𝗘𝗹𝗲𝗰𝘁𝗿𝗼𝗱𝗲 𝗠𝗮𝗿𝗸𝗲𝘁, 𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗢𝘂𝘁𝗹𝗼𝗼𝗸

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355