Report Overview

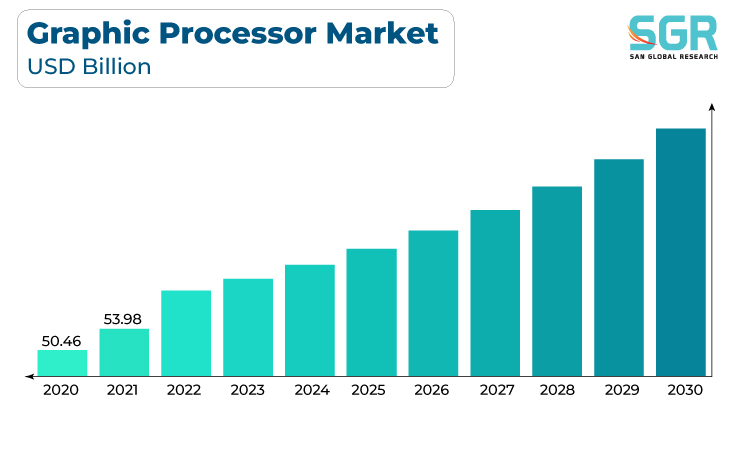

The Graphic Processor Market was valued at 55.96 billion in 2022 and expected to grow at CAGR of 28.93% over forecast period. The growing demand for high-quality graphics and visual computing across industries such as gaming, data centers, artificial intelligence, and automotive is driving the adoption of graphic processors (GPUs) due to their parallel processing capabilities. Second, advances in GPU technology, such as the creation of more powerful and energy-efficient GPUs, are broadening their applications in emerging technologies such as deep learning and real-time ray tracing. Furthermore, the rise of cloud computing, as well as the need for accelerated graphics performance in virtualization and remote desktop environments, is driving up demand for GPU solutions. Furthermore, the increased demand for high-resolution displays, virtual reality, and augmented reality experiences drives the demand for powerful GPUs to deliver immersive content.

The reliance of the cryptocurrency mining industry on GPUs for mining operations is contributing to market growth. Finally, the ongoing evolution of the gaming and content creation industries is increasing demand for GPUs to deliver realistic visuals and improved performance, making them an essential component in modern computing. These factors, taken together, determine the expansion and innovation in the Graphic Processor Market.

Component Outlook

Based on Component, the Graphic Processor Market is segmented Hardware, Software. Hardware segment accounted for largest share in 2022. The growing demand for high-performance graphics and parallel processing capabilities in a variety of industries, such as gaming, artificial intelligence, and scientific computing, is driving the adoption of hardware graphic processors (GPUs). These GPUs are critical for efficiently handling complex graphical and computational tasks. Second, advances in GPU architecture, such as increased core counts, improved energy efficiency, and real-time ray tracing capabilities, are broadening their range of applications and spurring upgrades in a variety of industries. Furthermore, the increasing popularity of cloud-based services and data centers necessitates the use of powerful GPUs for accelerated data processing, machine learning, and rendering tasks, which is driving market growth.

Several key factors are driving the software graphics processor market, including the increasing demand for high-quality visual content in applications such as gaming, virtual reality, and augmented reality, which necessitates more powerful and efficient software-based graphics processing units (GPUs). Furthermore, the rise of cloud-based gaming and streaming services has increased reliance on remote rendering and virtualization, driving up demand for software GPUs capable of delivering high-performance graphics over the internet. Furthermore, the growing popularity of AI and machine learning applications, which heavily rely on GPU acceleration, is fueling the demand for software-based GPU solutions that can support these computationally intensive tasks, making it a key driver in the software graphics processor market.

Type Outlook

Based on Type, Graphic Processor Market is segmented into Integrated, Discrete and Hybrid. integrated accounted for largest share in 2022. Several key factors are driving the integrated graphics processor market, including rising demand for power-efficient and compact computing devices such as laptops, ultrabooks, and tablets, where integrated GPUs offer a cost-effective and space-saving solution. Furthermore, the growing popularity of thin and light gaming laptops and portable workstations has resulted in advancements in integrated GPU performance, which has led to further market expansion. Furthermore, the increased demand for integrated GPUs capable of handling high-definition graphics and video playback on a wide range of devices has contributed to the market's growth.

This adaptability is especially desirable in laptops and ultrabooks, where users require both efficiency for everyday tasks and powerful graphics performance for gaming or content creation. Furthermore, the emergence of AI and machine learning workloads, which frequently benefit from GPU acceleration, has prompted the development of hybrid systems capable of dynamically allocating computing resources as needed, driving the adoption of such solutions in data centers and edge computing environments. The constant evolution of gaming and multimedia content, which necessitates increasingly powerful and adaptable GPU solutions to deliver immersive experiences across multiple platforms, fuels demand for hybrid graphics processors.

Deployment Outlook

Based on Deployment, Graphic Processor Market is segmented into On-premise and Cloud. Cloud accounted for largest share in 2022. Cloud-based GPU solutions provide the scalability and performance required to deliver seamless experiences over the internet as consumers and businesses seek access to high-quality graphics and multimedia content on a wide range of devices. Furthermore, the rise of virtual and augmented reality applications, which rely heavily on powerful GPUs, has increased the demand for cloud-based graphics processing to enable real-time, immersive experiences without the need for expensive local hardware. Furthermore, the growing adoption of AI and machine learning workloads in the cloud has increased demand for GPU acceleration, making cloud-based GPU resources critical for organizations looking to leverage these technologies for data analysis, training models, and more.

The on-premise graphics processor market is primarily driven by businesses and organizations that require localized, high-performance computing solutions for tasks demanding real-time processing, advanced graphics, and data privacy. Industries such as automotive, manufacturing, and healthcare rely on on-premise GPUs for tasks like computer-aided design, medical imaging, and simulations, where data security and low-latency processing are critical. Moreover, the gaming industry continues to drive demand for high-end GPUs for gaming rigs and workstations, as gamers seek to experience the latest titles at the highest quality

Application Outlook

Based on Application, Graphic Processor Market is segmented into Consumer Electronics, IT & Telecommunication, Healthcare, Media & Entertainment, Others. Consumer Electronics accounted for largest share in 2022. The consumer electronics graphics processor market is primarily driven by several key factors, including the ongoing demand for enhanced visual experiences in devices such as smartphones, tablets, smart TVs, and gaming consoles. As consumers increasingly engage with multimedia content, gaming, and virtual reality applications, the need for high-performance GPUs is paramount to deliver realistic graphics, smoother gameplay, and immersive viewing experiences. Additionally, the trend towards 4K and even 8K resolution displays, along with the emergence of ray tracing technology, has heightened the demand for more powerful GPUs in these devices to handle the rendering demands of high-quality graphics

The demand for high-quality visual content across multiple platforms drives the media and entertainment graphic processor market. Consumers expect cinematic experiences in streaming services, gaming, virtual reality, and augmented reality applications, necessitating the use of powerful GPUs capable of delivering realistic graphics and immersive environments.

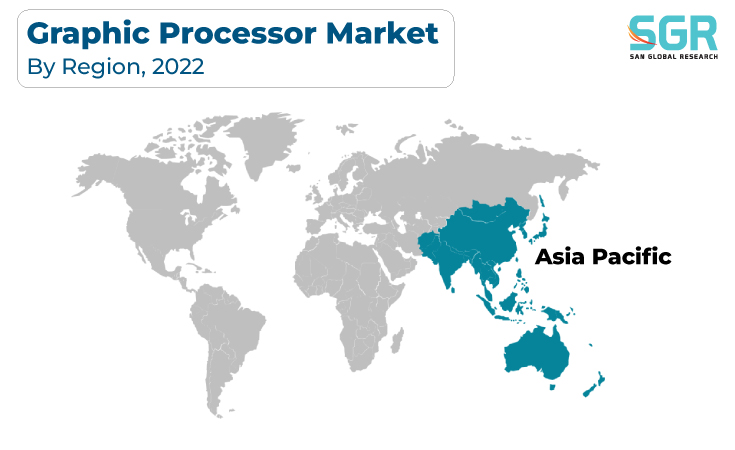

Regional Outlook

Asia Pacific is emerged as leading market for Graphic Processor Market in 2022. A number of factors are driving the Asia Pacific graphic processor market, including the region's rapid economic growth, burgeoning middle-class population, and increasing adoption of digital technologies. As a result, there is an increase in demand for consumer electronics, gaming consoles, and smartphones, all of which require advanced GPUs to provide high-quality graphics and gaming experiences. Furthermore, the region's growing gaming industry, both mobile and PC, fuels the demand for powerful GPUs to support gaming enthusiasts and esports.

The North American Graphic Processor Market is thriving due to several key factors. The popularity of gaming, both on PC and console, as well as the rise of esports, continue to drive demand for high-performance GPUs. Furthermore, North America is a center for content creation, such as film production, animation, and graphic design, all of which rely heavily on powerful GPUs for rendering and editing tasks. The proliferation of artificial intelligence and machine learning applications in industries such as healthcare, finance, and autonomous vehicles drives up demand for GPUs in data centers.

Graphic Processor Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 55.96 Billion |

| Forecast in 2030 | USD 372.98 Billion |

| CAGR | CAGR of 28.93% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Component, By type, By deployment, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Qualcomm Incorporated; Samsung Electronics Co., Ltd.; Imagination Technologies; VIA Technologies Inc.; Matrox Electronic Systems Ltd.; IBM; NVIDIA Corporation; Advanced Micro Devices Inc. (AMD); Intel Corporation; |

Global Graphic Processor Market, Report Segmentation

Graphic Processor Market, By Component

- Hardware

- Software

- Services

Graphic Processor Market, By Type

- Integrated

- Discrete

- Hybrid

Graphic Processor Market, By Deployment

- On-premise

- Cloud

Graphic Processor Market, By Application

- Consumer Electronics

- IT & Telecommunication

- Healthcare

- Media & Entertainment

- Others

Graphic Processor Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355