Report Overview

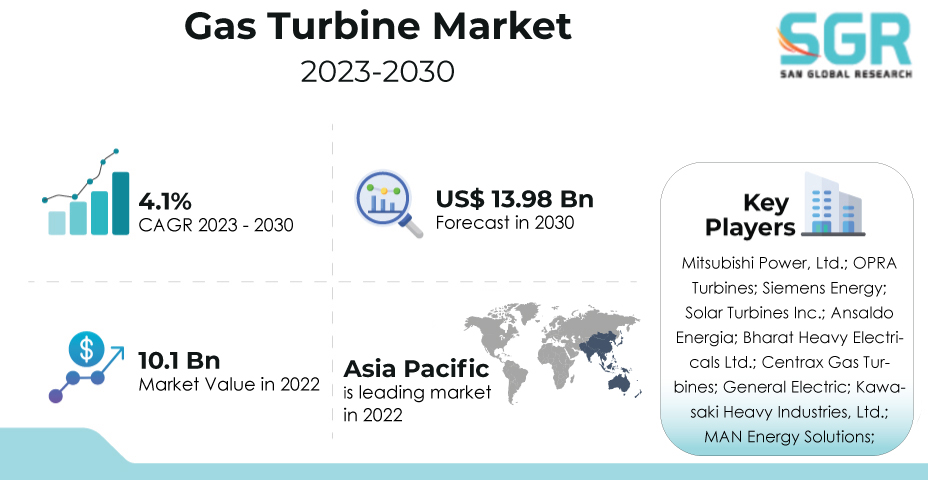

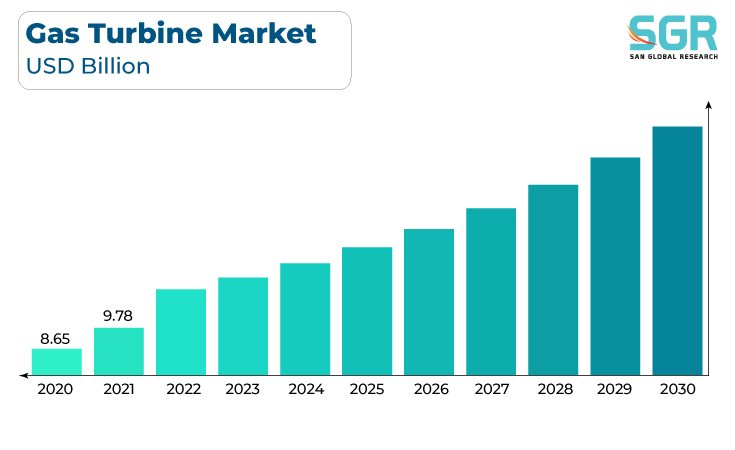

The Gas Turbine Market was valued at 10.1 Billion in 2022 and expected to grow at CAGR of 4.9% over forecast period.

The Gas Turbine market is driven by a complex interplay of factors that underscore its pivotal role in providing efficient and flexible power generation solutions. The global focus on energy security, along with the need to reduce carbon emissions and address climate change, drives the adoption of gas turbines as a cleaner alternative to traditional fossil fuel-based power plants. Technological advancements in gas turbine design, efficiency, and emissions reduction capabilities enhance their appeal.

The growing demand for gas turbines in various industries is fueled by the push for decentralized energy systems, grid stability, and reliable power supply. Collaborations among energy companies, research institutions, and governments foster innovation by refining gas turbine technologies, optimizing fuel utilization, and solidifying their position as a key driver of the global transition to more sustainable and flexible energy generation.

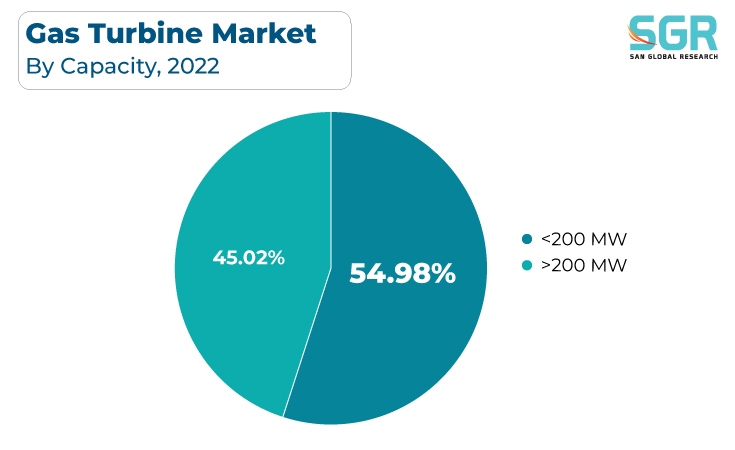

Capacity Outlook

Based on Capacity, the Gas Turbine Market is segmented into 200 MW. >200 MW segment accounted for largest share in 2022. Gas turbines with capacities greater than 200 MW have high efficiency and flexibility, making them suitable for utility-scale power plants and industrial applications. Technological advances in turbine design, combined with the ability to integrate with renewable energy sources, make the market more appealing. Adoption of these high-capacity gas turbines is driven by the need to reduce carbon emissions, support grid stability, and maximize energy efficiency. Collaborations among energy companies, utilities, and research institutions foster innovation by refining >200 MW gas turbine technologies, optimizing fuel utilization, and addressing the evolving energy landscape in order to provide sustainable and scalable power solutions.

Gas turbines with capacities less than 200 MW offer a versatile option for a variety of applications as industries and communities seek reliable and sustainable energy sources. Technological advances in turbine design, fuel efficiency, and emission reduction increase their appeal, especially for smaller-scale projects and distributed energy systems.

End-Use Outlook

Based on End-Use, Gas Turbine Market is segmented into Industrial, Power & Utility. Power & Utility accounted for largest share in 2022. The global emphasis on energy security, combined with the need to reduce carbon emissions and shift to cleaner energy sources, drives the use of gas turbines in power generation. Technological advances in turbine design, efficiency, and emission reduction boost their appeal, particularly in large-scale utility applications. The need to optimize energy production, maintain grid stability, and address environmental concerns drives up demand for gas turbines in the power and utility sectors. Collaborations among energy companies, utilities, and regulatory bodies foster innovation by refining gas turbine technologies to provide sustainable and adaptable power solutions, thereby contributing to the advancement of reliable energy generation, grid resilience, and the broader goal of a cleaner energy future.

Technological advancements in gas turbine design, fuel efficiency, and emission reduction increase their appeal, especially in industries such as manufacturing, oil and gas, and chemicals. The need to ensure continuous energy supply, improve process efficiency, and reduce carbon emissions is driving the adoption of industrial gas turbines. Collaborations among energy companies, industrial sectors, and regulatory bodies foster innovation by refining gas turbine technologies to meet the unique energy requirements of industrial settings, resulting in sustainable energy solutions that boost industrial productivity, energy resilience, and environmental sustainability.

Technology Outlook

Based on Technology, Gas Turbine Market is segmented into Combined Cycle, Open Cycle. Combined Cycle accounted for largest share in 2022.The global emphasis on energy efficiency and emissions reduction drives the adoption of combined cycle gas turbine (CCGT) plants, which combine gas turbines and steam turbines to maximize energy conversion. Technological advances in CCGT system integration, fuel efficiency, and emissions control increase their appeal, especially for utilities and industries seeking to balance energy demand with environmental concerns. The demand for CCGT solutions is increasing due to the need to optimize energy output, support grid stability, and reduce carbon emissions.

The adoption of OCGT plants is driven by the global focus on energy security, as well as the need to accommodate fluctuating energy demand and grid stability. Turbine design, efficiency, and quick start-up capabilities have improved, making them more appealing for peak load and emergency power generation. The need to improve grid reliability, optimize energy availability, and address energy supply variability is driving up demand for OCGT solutions.

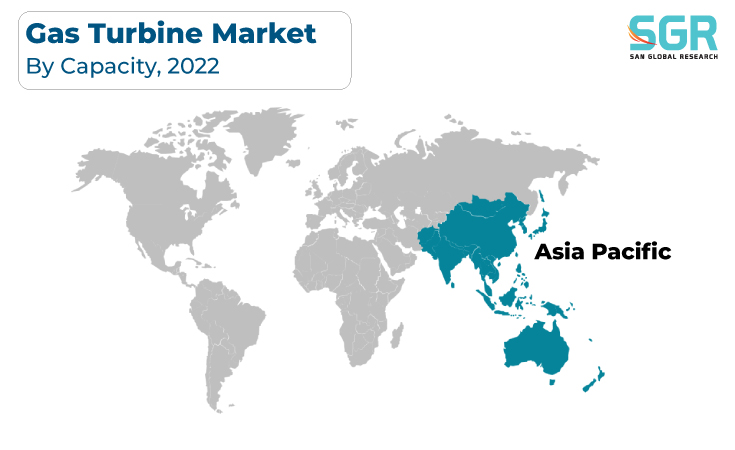

Regional Outlook

Asia Pacific is emerged as leading market for Gas Turbine Market in 2022. The Asia Pacific Gas Turbine market is driven by a dynamic mix of influential factors that highlight its critical role in meeting the region's surging energy demand, promoting economic growth, and advancing sustainable energy solutions. The region's rapid industrialization, urbanization, and population growth drive the demand for efficient and dependable power generation technologies. Government initiatives, policies promoting cleaner energy sources, and energy security all contribute to the increased use of gas turbines. Technological advances in gas turbine design, emissions reduction, and efficiency improvements are consistent with the region's commitment to sustainable development.

Gas turbines are being adopted as a cleaner and more flexible power generation solution as a result of the push for decarbonization and stringent emission reduction targets. Government policies, incentives, and renewable energy mandates spur market growth by encouraging the integration of gas turbines with renewable energy sources for increased efficiency.

Gas Turbine Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 10.1 Billion |

| Forecast in 2030 | USD 13.98 Billion |

| CAGR | CAGR of 4.1% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Capacity, By End-use, By Technology |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Mitsubishi Power, Ltd.; OPRA Turbines; Siemens Energy; Solar Turbines Inc.; Ansaldo Energia; Bharat Heavy Electricals Ltd.; Centrax Gas Turbines; General Electric; Kawasaki Heavy Industries, Ltd.; MAN Energy Solutions; |

Global Gas Turbine Market, Report Segmentation

Gas Turbine Market, By Capacity

- <200MW

- >200MW

- Micro

Gas Turbine Market, By End-Use

- Industrial

- Power & utility

Gas Turbine Market, By Technology

- Combined Cycle

- Open Cycle

Gas Turbine Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355