Report Overview

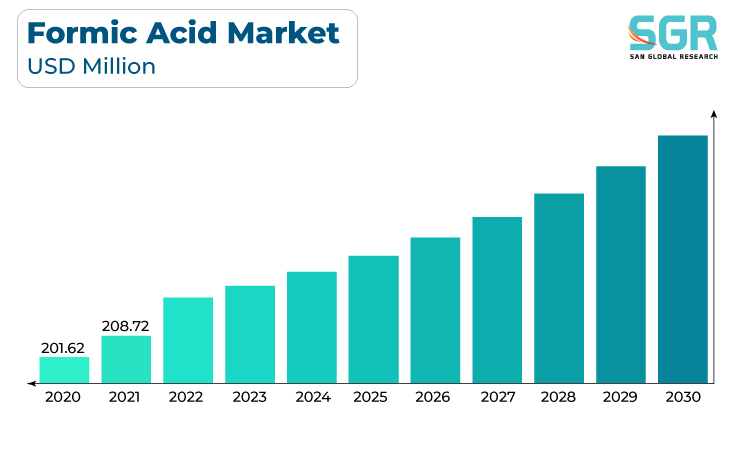

The formic acid Market was valued at 216.86 million in 2022 and expected to grow at CAGR of 4.2% over forecast period.

Formic acid is extensively used in the textile industry for dyeing and finishing processes. Its properties make it a versatile component in textile manufacturing.The growth of the textile industry, driven by increasing global demand for apparel and fabrics, is a significant driver for formic acid demand. Furthermore, Formic acid is a key ingredient in leather processing, employed in tanning and dyeing procedures.As the global demand for leather products rises, especially in fashion and automotive sectors, the demand for formic acid in leather processing increases correspondingly.

In addition, Formic acid is used in the production of various agrochemicals, contributing to their effectiveness and stability.The expanding agriculture sector, coupled with the need for efficient crop protection and fertilizers, supports the demand for formic acid in agrochemical manufacturing

Formic acid is explored as a potential hydrogen carrier in renewable energy applications.Research and development in the renewable energy sector, especially hydrogen storage, can drive increased demand for formic acid.

Application Outlook

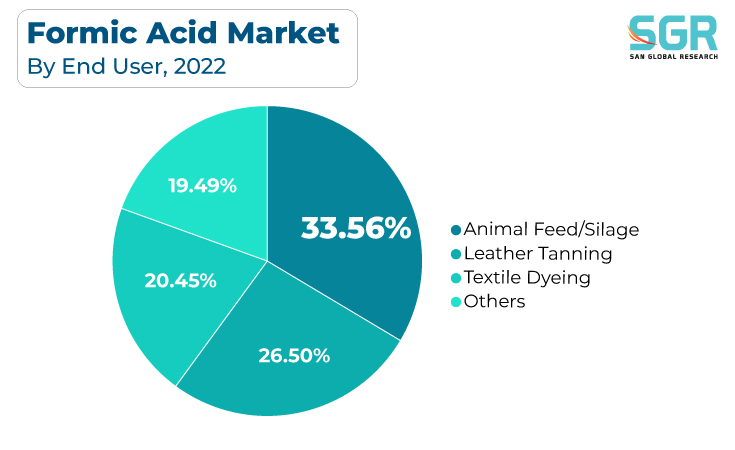

Based onend user, the formic acidmarketis segmented animal feed/silage, leather tanning, textile dyeing, others.animal feed/silagesegmentaccounted for largest share in 2022.Animal feed/silageis used in animal feed preservation due to its ability to inhibit the growth of spoilage microorganisms. This helps in preserving the nutritional quality of the feed.As livestock farming intensifies globally to meet the demand for meat and dairy, the need for high-quality preserved animal feed becomes crucial for maintaining the health and productivity of livestock. Formic acid plays a vital role in this preservation process.

Moreover, Formic acid is commonly used in the ensiling process to inhibit undesirable microorganisms, preventing spoilage and promoting the production of high-quality silage.High-quality silage is essential for livestock nutrition, especially during periods of feed scarcity. Formic acid's role in maintaining silage quality directly influences the health and productivity of animals.

Thus, the growth of the formic acid market is driven by the indispensable roles it plays in preserving the nutritional quality of animal feed and silage. As global demand for high-quality meat and dairy products increases, the importance of effective feed preservation becomes a significant factor influencing the adoption of formic acid in the agricultural and livestock sectors.

Regional Outlook

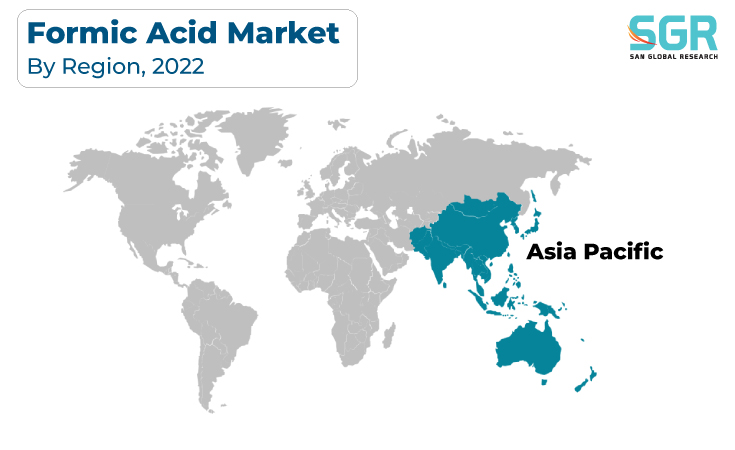

Asia-Pacific has emerged as leading market for formic acidmarket in 2022. Several key factors are driving the Asia-Pacific formic acidmarketsuch as the textile industry in Asia-Pacific is one of the largest in the world. Formic acid is extensively used in textile manufacturing processes, including dyeing and finishing.The growth of the textile industry in Asia-Pacific, driven by both domestic and international demand, fuels the demand for formic acid as a crucial component in textile production.

The leather industry in Asia-Pacific is expanding, driven by increasing consumer demand for leather products, including footwear and accessories. Formic acid is a key component in leather processing.The growth in the leather industry directly influences the formic acid market, as more of the acid is required for tanning and dyeing processes.

Hence, the Asia-Pacific region's economic growth, industrialization, and the expansion of key industries such as textiles, agriculture, and manufacturing are key drivers for the growth of the formic acid market in the region. The dynamic nature of these industries and the increasing focus on sustainability and quality further contribute to the sustained demand for formic acid.

Formic Acid Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD216.86Million |

| Forecast in 2030 | USD301.46Million |

| CAGR | CAGR of 4.2% from 2023 to 2030 |

| Base Year of forecast | Base Year of forecast |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Application, By End-User |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | BASF SE, Eastman Chemical Company, Perstorp Holding AB, Feicheng Acid Chemicals Co., Ltd. ,Shandong Hualu-Hengsheng Chemical Co., Ltd. , Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC) , Chongqing Chuandong Chemical (Group) Co., Ltd., Samsung Fine Chemicals, Luxi Chemical Group Co., Ltd., Taminco Corporationamong Others |

Formic Acid Market, Report Segmentation

Formic Acid Market, By Application

- Animal Feed, Silage

- Leather Tanning

- Textile Dyeing

- Other

Formic Acid Market, By End-User

- Agriculture

- Pharmaceutical

Formic Acid Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355