Report Overview

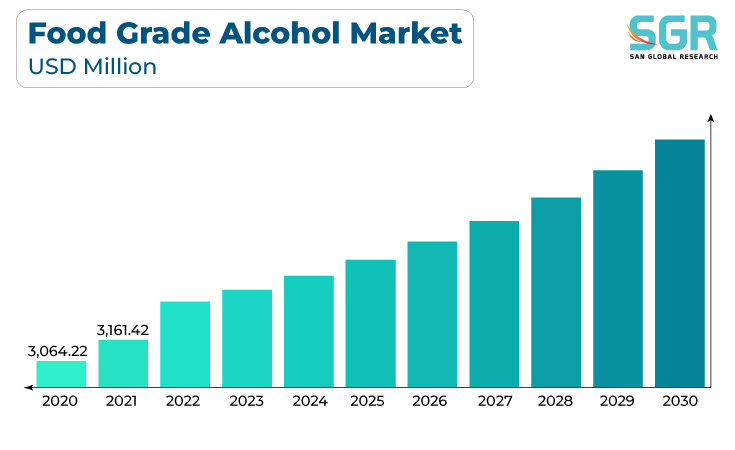

The food grade alcohol market was valued at 3,264.02 million in 2022 and expected to grow at CAGR of 3.6% over forecast period.

Consumers are increasingly seeking natural and organic food and beverage products. Food-grade alcohol, especially when derived from renewable and organic sources, is preferred for its compatibility with clean label and sustainable food production. Thus, growing demand for natural and organic products are driving the growth of food grade alcohol market.

Furthermore, food-grade alcohol, particularly ethanol, is used to extract and enhance natural flavors, fragrances, and essential oils from botanical sources. The demand for authentic and natural flavors in processed foods and beverages drives the use of food-grade alcohol in flavor extraction.

Food-grade alcohol is used in baking and confectionery applications to control texture and moisture content in dough and batters. It also plays a role in flavor enhancement and mold release in the production of chocolates, candies, and icing. Hence, these drivers collectively contribute to the growth of the food-grade alcohol market as it continues to play a critical role in various aspects of the food and beverage industry

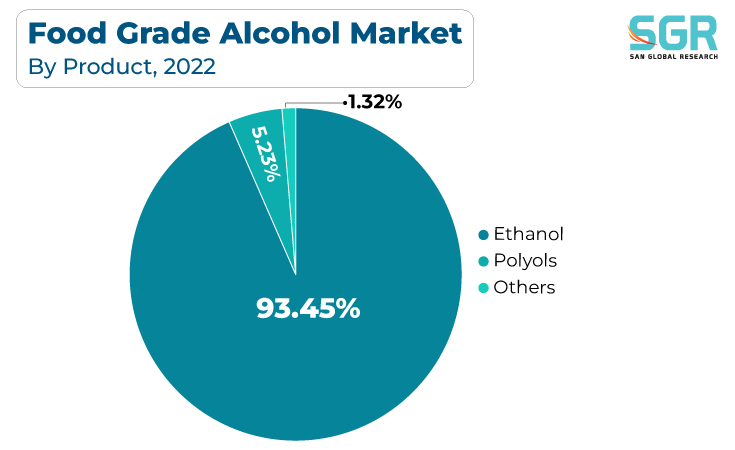

Product Outlook

Based on product, the food grade alcohol market is segmented into food & beverages, chemicals, pharmaceuticals, electronics, and others. Ethanol is a primary ingredient in the production of alcoholic beverages such as beer, wine, spirits, and liqueurs. The growth of the alcoholic beverage industry, including the craft beer and spirits segments, has led to increased demand for food-grade ethanol. Additionally, Ethanol serves as a solvent for extracting natural flavors, fragrances, and essential oils from botanical sources. These extracts are crucial for flavoring a wide range of food and beverage products, from soft drinks to baked goods and confections. Hence, such type of applications is fueling the growth of ethanol in food grade alcohol market.

Furthermore, Ethanol acts as a natural preservative, extending the shelf life of certain food products, including sauces, dressings, and marinades. It helps inhibit the growth of microorganisms and spoilage.

Thus, ethanol's broad range of applications in food and beverage production, as well as its compatibility with consumer preferences for natural, safe, and sustainable ingredients, positions it as a driving force in the growth of the food-grade alcohol market.

Regional Outlook

North America has emerged as leading market for food grade alcohol market in 2022. Several key factors are driving the North America has a well-established and continuously growing beverage industry, which includes alcoholic beverages, non-alcoholic beverages, and craft beverages. Food-grade alcohol, particularly ethanol, is a key ingredient in the production of alcoholic beverages, flavor extracts, and spirits. As consumer preferences evolve and craft beverage production expands, the demand for food-grade alcohol in this region rises.

Furthermore, North America is home to a thriving flavor and fragrance industry, which relies on food-grade alcohol as a solvent and carrier for various flavorings and fragrances. The demand for processed and convenience foods, as well as the growth of the flavor and fragrance market, contributes to the need for food-grade alcohol.

Hence, North America's diverse food and beverage industry, coupled with its focus on quality, innovation, and safety, makes it a key driver in the growth of the food-grade alcohol market. The region's evolving consumer trends, coupled with the COVID-19 pandemic's impact on hygiene and sanitation, have further accelerated the demand for food-grade alcohol in various applications.

Food Grade Alcohol Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 3,264.02 Million |

| Forecast in 2030 | USD 4,332.67 Million |

| CAGR | CAGR of 3.6% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Grain Processing Corporation, GreenField Global, MGP Ingredients, S A Internationl, Spectrum Chemical Manufacturing Corp., Manildra Group, ITW Reagents, S.R.L. and GLACIAL GRAIN SPIRITS among others |

Global Food Grade Alcohol Market, Report Segmentation

Food Grade Alcohol Market, By Product

- Chlor-alkali

- Surfactants

- Solvents

- Phosphates

- Other

Food Grade Alcohol Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355