Report Overview

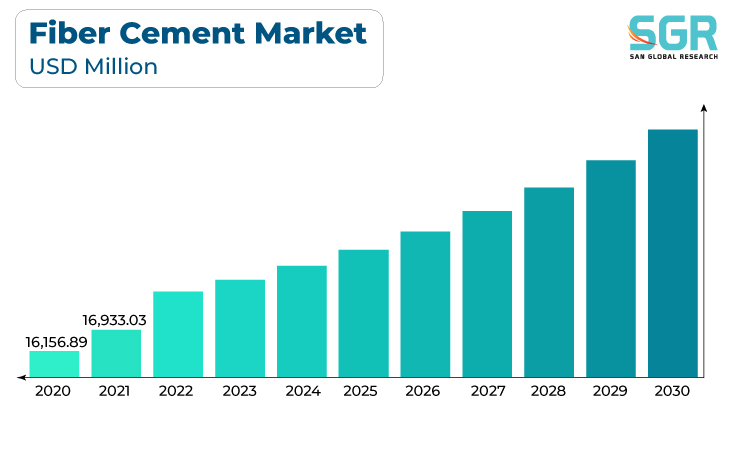

The Fiber cement Market was valued at 17,755.40 million in 2022 and expected to grow at CAGR of 5.1% over forecast period.

Fiber cement products are known for their durability and resistance to various weather conditions, including moisture, UV rays, and extreme temperatures. This makes them suitable for diverse climates and contributes to their long lifespan. Furthermore, Fiber cement requires relatively low maintenance compared to traditional building materials. Its resistance to rot, pests, and decay reduces the need for frequent repairs and replacements.

In addition, fiber cement is inherently fire-resistant, providing an added layer of safety in construction. This feature makes it a preferred material for applications where fire safety is a critical consideration.

The global construction industry's growth contributes significantly to the demand for building materials, including fiber cement. As urbanization and infrastructure development continue, the need for durable and reliable construction materials rises.

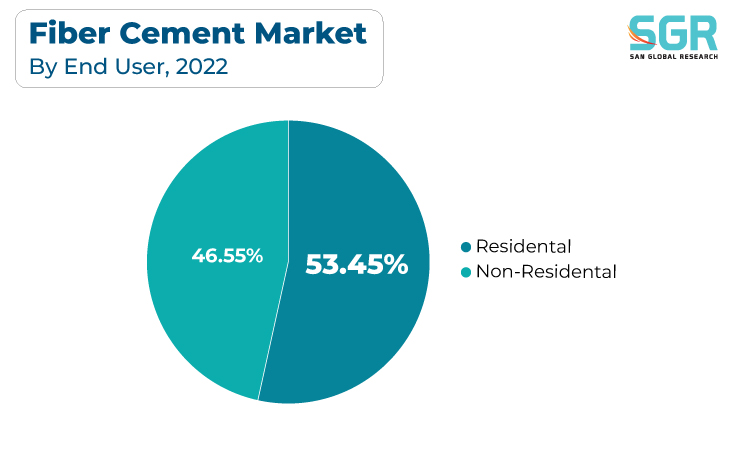

End User Outlook

Based on end user, the fiber cement market is segmented into non-residential, and residential. Residential segment accounted for largest share in 2022. Fiber cement siding is widely used in residential construction due to its durability, low maintenance, and resistance to weather conditions. Homeowners appreciate the aesthetic appeal of fiber cement siding, which can mimic the look of wood or other materials. Also, Fiber cement roofing materials are sought after for their fire resistance, durability, and ability to withstand harsh weather conditions. Residential buildings, particularly in areas prone to wildfires or severe weather, often choose fiber cement roofing for enhanced safety and longevity.

Moreover, fiber cement boards can be molded and shaped to meet various architectural designs. This flexibility allows for unique and customized residential structures, contributing to the popularity of fiber cement in upscale and modern home designs.

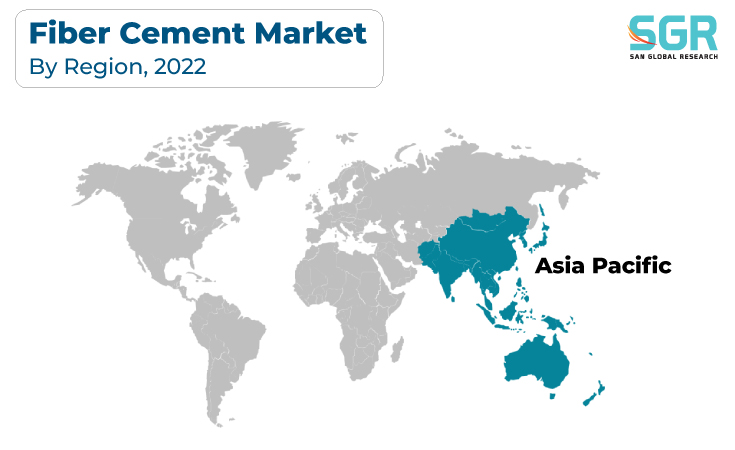

Regional Outlook

Asia-Pacific has emerged as leading market for fiber cement market in 2022. Several key factors are driving the Asia-Pacific Fiber cement Market such as the Asia-Pacific region is witnessing a swift pace of urbanization as populations shift from rural to urban areas. This trend has spurred extensive construction activities, creating a heightened demand for construction materials, with fiber cement being a preferred choice. Many countries in Asia-Pacific are experiencing robust construction growth, primarily fueled by infrastructure development initiatives, residential housing projects, and commercial building constructions. Fiber cement, recognized for its durability and versatility, is in high demand for these diverse construction projects.

Asia-Pacific region's growth in the fiber cement market is propelled by urbanization, a thriving construction industry, rising residential housing demands, climate adaptability, government investments, increased awareness, regulatory compliance, and a focus on sustainable practices. These factors collectively underscore the pivotal role of the Asia-Pacific region in driving the expansion of the fiber cement market.

Fiber Cement Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 17,755.40 Million |

| Forecast in 2030 | USD 26,438.85 Million |

| CAGR | CAGR of 5.1% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Raw Material, By Construction type, By End User |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | James Hardie Industries PLC, Etex Group, Cembrit Holding A/S, Nichiha Corporation, Swisspearl Group, Eternit SA, Visaka Industries Limited, Elementia S.A.B. de C.V., Hume Cemboard Industries Sdn Bhd and Everest Industries Limited among Others |

Global Fiber Cement Market, Report Segmentation

Fiber Cement Market, By Raw Material

- Portland cement

- Silica

- Cellulosic Fiber

- Other

Fiber Cement Market, By Construction Type

- Siding

- Roofing

- Molding & Trim

- Others

Fiber Cement Market, By End User

- Non-Residential

- Residential

Fiber Cement Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355