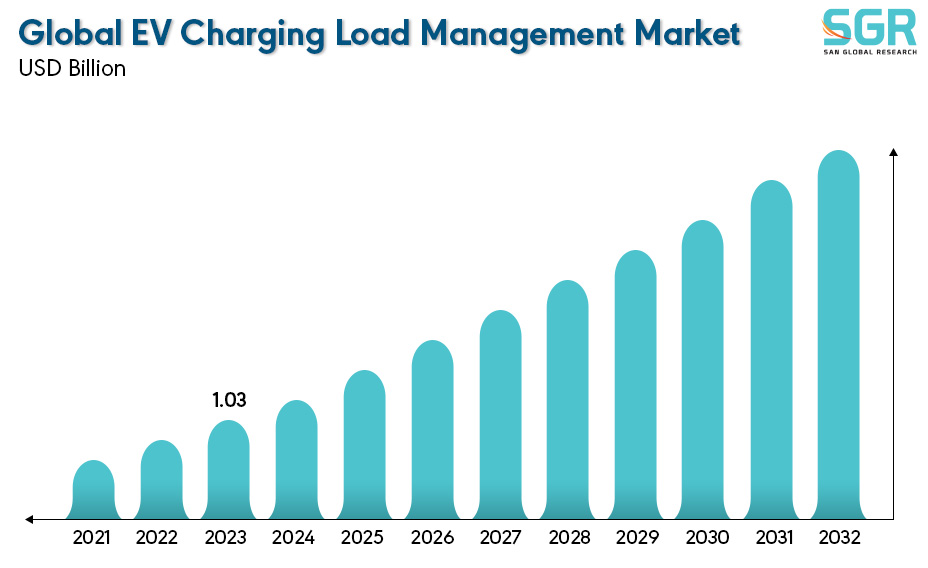

EV Charging Load Management Market is estimated to be worth USD 1.03 Billion in 2023 and is projected to grow at a CAGR of 26.7% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application and by region/country.

The EV (Electric Vehicle) Charging Load Management Market refers to the industry segment focused on managing the charging of electric vehicles in a way that optimizes energy usage, minimizes grid strain, and ensures efficient charging infrastructure deployment. As more electric vehicles are adopted globally, there is a growing need for solutions that can handle the increased demand for electricity caused by charging these vehicles. The key components of the EV Charging Load Management Market includes Smart Charging Infrastructure, Load Balancing Solutions, Demand Response Systems, Grid Integration Technologies, Energy Management Software etc. The EV Charging Load Management Market is driven by factors such as the increasing adoption of electric vehicles, government incentives promoting clean transportation, the need for grid stability, and advancements in smart grid technologies. It encompasses various stakeholders including EV manufacturers, charging station operators, utilities, technology providers, and regulatory bodies. The market is expected to grow significantly in the coming years as electric vehicle adoption continues to accelerate globally, necessitating more sophisticated and efficient charging infrastructure management solutions.

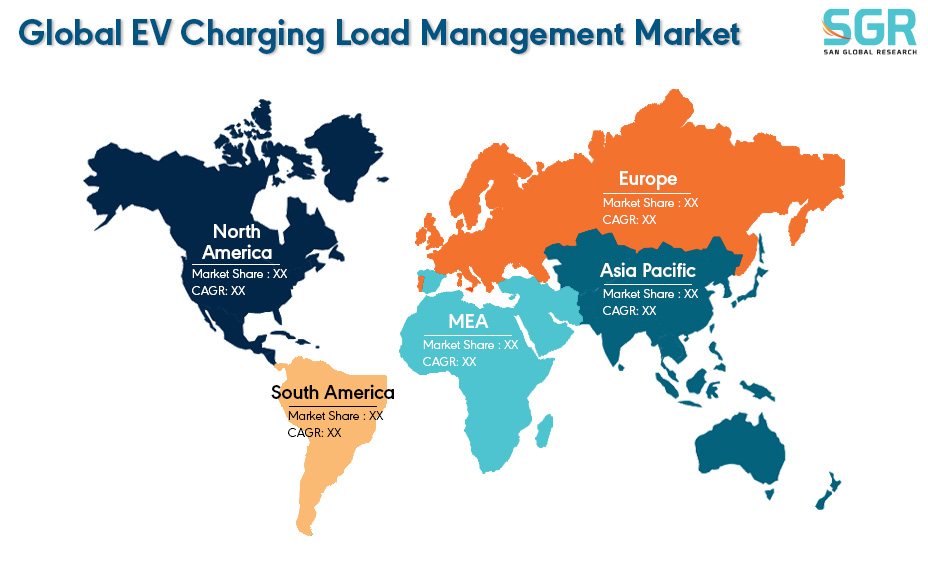

Region wise Comparison:

North America has seen a significant increase in the adoption of electric vehicles, driven by factors such as environmental concerns, advancements in EV technology, and decreasing battery costs. As more electric vehicles hit the roads, there is a growing need for efficient charging infrastructure and load management solutions to support them.

European countries have been at the forefront of implementing stringent emissions regulations and offering incentives to promote the adoption of electric vehicles. Incentives such as subsidies for purchasing electric vehicles and grants for installing charging infrastructure contribute to the growing demand for EV Charging Load Management solutions.

The Asia-Pacific region is experiencing rapid urbanization and population growth, leading to increased demand for transportation solutions. Governments and city planners are increasingly turning to electric vehicles to address pollution and congestion issues in urban areas, driving the need for efficient charging infrastructure and load management solutions.

Rapid urbanization and economic development in certain parts of the MEA region, particularly in urban centers like Dubai, Abu Dhabi, Riyadh, and Johannesburg, lead to increased demand for transportation solutions. Electric vehicles are seen as a way to address pollution and congestion in these cities, driving the need for charging infrastructure and load management solutions. The adoption of electric vehicles is not limited to personal transportation but also extends to commercial and industrial applications such as electric buses, taxis, and delivery vehicles. Efficiently managing the charging of these vehicles is crucial for businesses to optimize operations and reduce costs, driving demand for EV Charging Load Management solutions.

.jpg)

Segmentation:

The EV Charging Load Management Market is segmented by Type, by Application and by region/country.

By Type:

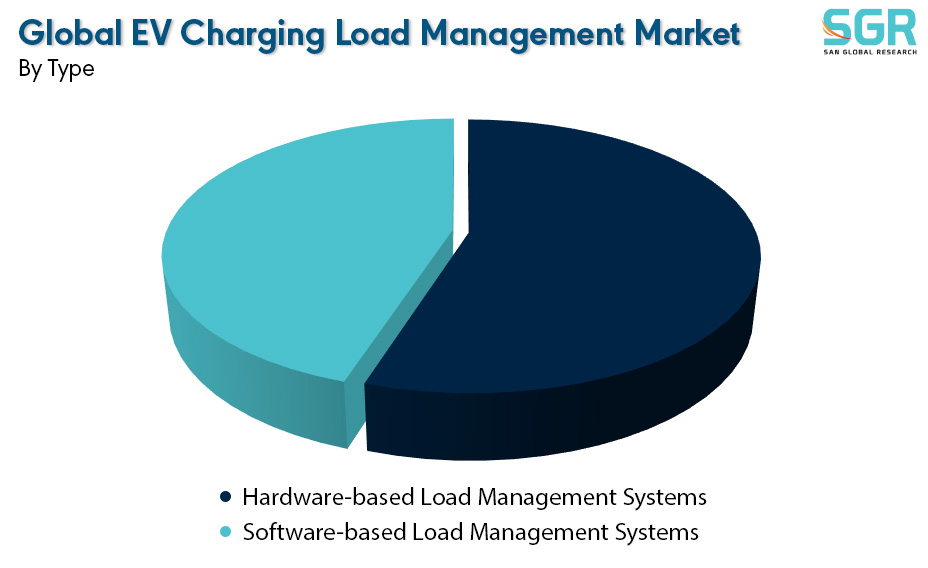

Based on the type, the EV Charging Load Management Market is bifurcated into Hardware-based Load Management Systems and Software-based Load Management Systems – where Hardware-based Load Management Systems is dominating and ahead in terms of share.

Hardware-based Load Management Systems in EV Charging Load Management refer to systems that utilize physical devices or components to manage and control the charging load of electric vehicles. These systems typically involve the installation of specialized hardware at charging stations or within the electrical infrastructure to monitor, regulate, and optimize the distribution of electricity for charging electric vehicles.

Hardware-based load management systems play a crucial role in ensuring the efficient operation of EV charging infrastructure, optimizing energy usage, and maintaining grid stability. By leveraging advanced hardware components and technologies, these systems enable the reliable and scalable deployment of electric vehicle charging solutions while minimizing the impact on the electrical grid.

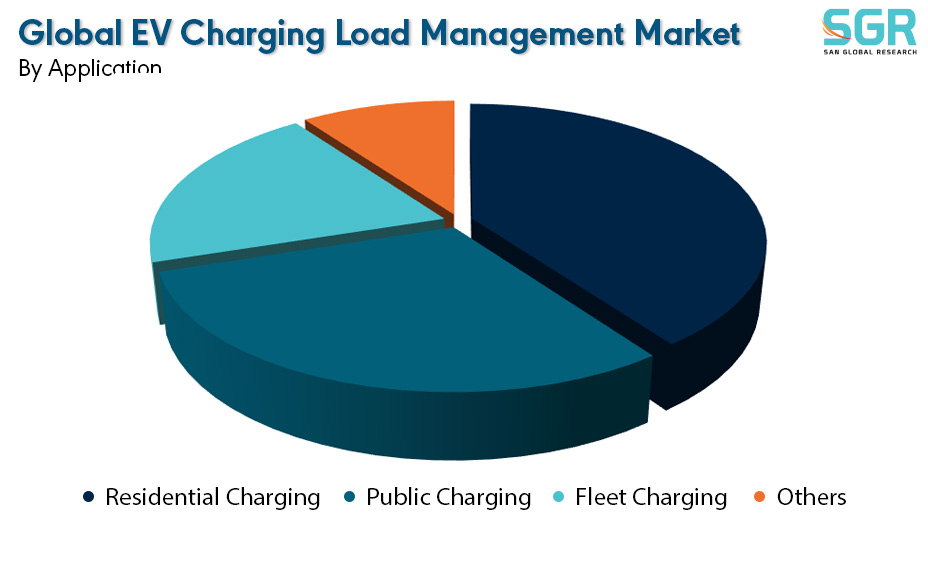

By Application:

Based on the Application, the EV Charging Load Management Market is bifurcated into Residential Charging, Public Charging , Fleet Charging & Others – where Land Route is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the EV Charging Load Management Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the EV Charging Load Management Market include

• Circontrol

• Elinta Charge

• Ampcontrol

• Schneider Electric Evlink

• Thundergrid

• gridX

• eMabler

• Hager

• AMPECO

• Smappee

• Mobility House

• Chargebay

Drivers:

Growth of Electric Vehicle Adoption

As more consumers and businesses switch to electric vehicles, there is a corresponding increase in the demand for charging infrastructure. This includes both public charging stations and private charging solutions at homes, workplaces, and commercial properties. The proliferation of charging infrastructure creates opportunities for load management solutions to optimize the utilization of these charging resources. The rise in electric vehicle adoption presents challenges related to managing the charging load on the electrical grid. Without effective load management, concentrated charging demand can lead to grid strain, peak demand spikes, and potential infrastructure upgrades. Load management solutions help mitigate these challenges by distributing charging loads intelligently, balancing grid demand, and optimizing energy usage. The increasing adoption of electric vehicles worldwide is a significant driver for the EV Charging Load Management market. As more consumers and businesses transition to electric vehicles, there is a growing need for efficient and scalable charging infrastructure, creating opportunities for load management solutions.

Opportunity:

Smart Grid Integration

Smart Grid Integration plays a pivotal role in optimizing the management of electric vehicle (EV) charging loads by facilitating communication and coordination between charging infrastructure and the broader electrical grid. Smart Grid Integration enables continuous monitoring of grid conditions, electricity demand, and charging infrastructure status in real-time. This allows load management systems to dynamically adjust charging rates and schedules based on grid capacity, voltage levels, and other factors to ensure grid stability and reliability. Overall, Smart Grid Integration enhances the effectiveness, efficiency, and reliability of EV Charging Load Management solutions by providing real-time monitoring and control, optimizing charging profiles, enabling participation in demand response programs, enhancing grid stability, integrating with renewable energy sources, and delivering valuable data-driven insights. As electric vehicle adoption continues to grow, Smart Grid Integration will play a critical role in ensuring the seamless integration of electric vehicles into the grid while maximizing the benefits of clean transportation.

| Report Attribute | Details |

| Market Value in 2023 | 1.02 Billion |

| Forecast in 2032 | 8.6 Billion |

| CAGR | CAGR of 26.7% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | Circontrol, Elinta Charge, Ampcontrol, Schneider Electric Evlink, Thundergrid, gridX, eMabler, Hager, AMPECO, Smappee, Mobility House, Chargebay. |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355