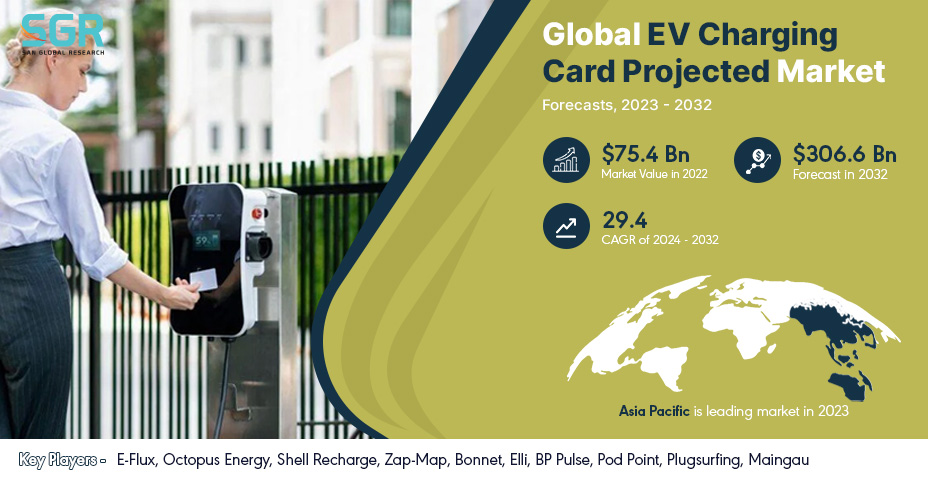

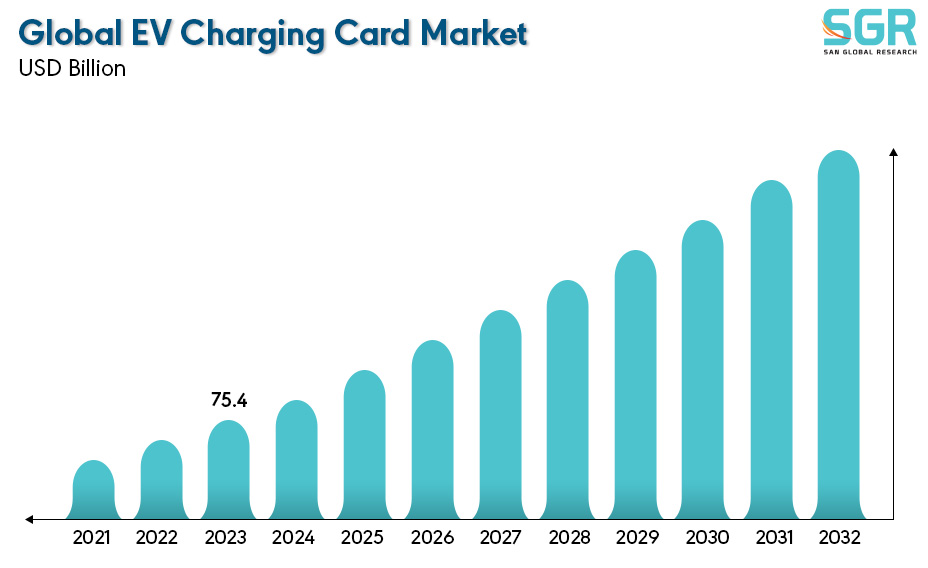

Global EV Charging Card Market is estimated to be worth USD 75.4 Billion in 2022 and is projected to grow at a CAGR of 29.4% between 2023 to 2032.

The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Application and by region/country.

The global Electric Vehicle (EV) charging card market has witnessed significant growth and transformation as the automotive industry embraces sustainable mobility solutions. EV charging cards play a pivotal role in facilitating seamless and convenient charging experiences for electric vehicle owners worldwide. These cards provide users with access to an extensive network of charging stations, allowing them to charge their electric vehicles efficiently. The market has been driven by the increasing adoption of electric vehicles, government initiatives promoting clean energy, and a growing awareness of environmental sustainability. As major players in the automotive and energy sectors continue to invest in infrastructure development, the EV charging card market is expected to expand further, offering users enhanced accessibility and interoperability across different charging networks. The market dynamics are also influenced by advancements in technology, with smart charging solutions and mobile applications contributing to a more user-friendly and efficient charging ecosystem. As the demand for electric vehicles continues to rise, the global EV charging card market is poised for continued growth and innovation.

.jpg)

Region wise Comparison:

In North America, the Electric Vehicle (EV) charging card market has seen rapid expansion, propelled by a surge in electric vehicle adoption and a strong commitment to sustainable practices. Government incentives, coupled with a growing eco-conscious consumer base, have fostered an environment conducive to the proliferation of EV charging infrastructure

Europe has emerged as a frontrunner in the global EV charging card market, reflecting the region's ambitious targets for reducing carbon emissions and promoting green mobility. Robust regulatory support, coupled with substantial investments in charging infrastructure, has led to a well-developed and interconnected network of charging stations.

.jpg)

The Asia Pacific region has witnessed a significant uptick in the EV charging card market, driven by the rapid adoption of electric vehicles in countries like China, Japan, and South Korea. Government initiatives, favorable policies, and a burgeoning awareness of environmental issues have spurred investments in charging infrastructure.

In Latin America, the EV charging card market is in its nascent stages, but the region shows promise as governments increasingly prioritize sustainable transportation. Initiatives promoting electric vehicle adoption are gaining traction, supported by a growing awareness of the environmental impact of traditional transportation.

The EV charging card market in Africa is gradually gaining momentum, with a focus on fostering sustainable transportation solutions. Governments across the continent are beginning to recognize the potential of electric vehicles in addressing environmental concerns and energy efficiency.

In the Middle East, the EV charging card market is experiencing steady growth, driven by a combination of government initiatives and a growing interest in renewable energy. Countries like the United Arab Emirates are leading the way with ambitious goals for sustainable transportation.

.jpg)

Segmentation:

The Global EV Charging Card Market is segmented by Type, by Application and by region/country.

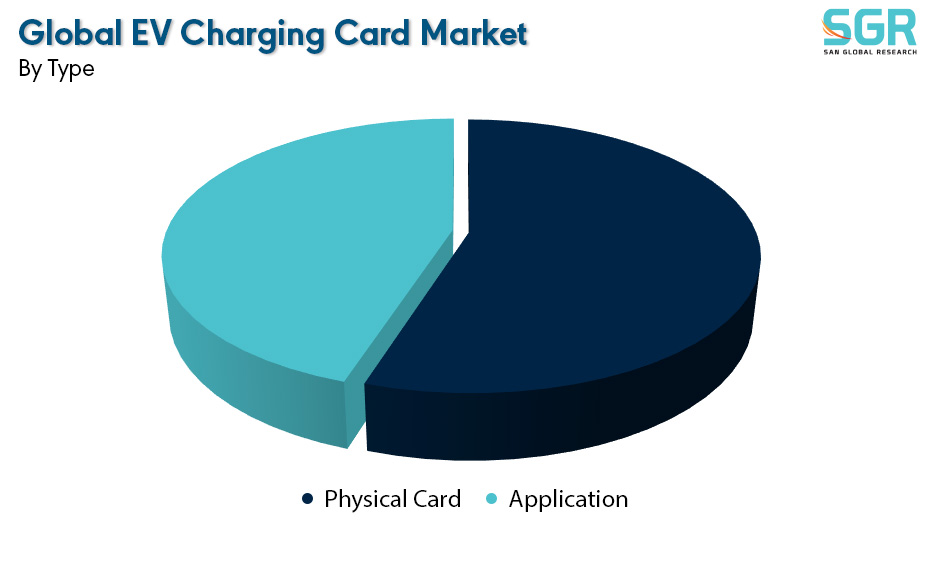

By Type:

Based on the type, the Global EV Charging Card Market is bifurcated into Physical Card & Application – where Physical Card is dominating and ahead in terms of share.

The physical card aspect of the global Electric Vehicle (EV) charging card market represents a tangible and user-friendly interface within the larger ecosystem. These cards serve as access keys to charging stations, allowing electric vehicle owners to initiate and conclude charging sessions seamlessly. Typically resembling traditional credit or debit cards, EV charging cards are equipped with RFID or NFC technology, enabling secure and efficient communication with charging infrastructure. Users can easily insert or tap their physical card at charging stations, streamlining the authentication process.

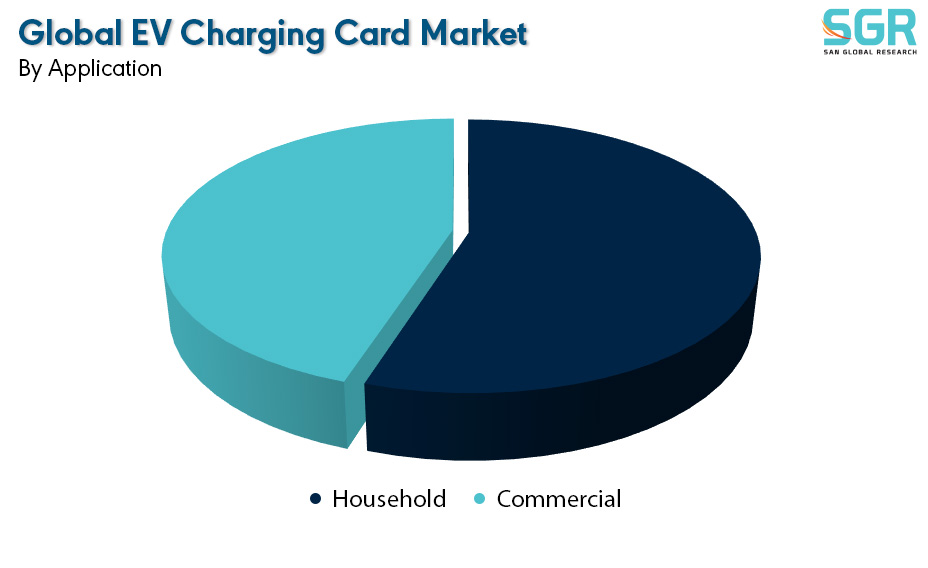

By Application:

Based on the Application, the Global EV Charging Card Market is bifurcated into Household & Commercial – where Household is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global EV Charging Card Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global EV Charging Card Market include

• E-Flux

• Octopus Energy

• Shell Recharge

• Zap-Map

• Bonnet

• Elli

• BP Pulse

• Pod Point

• Plugsurfing

• Maingau

Drivers:

Growing sector across the globe

The global Electric Vehicle (EV) charging card market is propelled by a confluence of factors that underscore the transformative shift towards sustainable transportation. One of the primary drivers is the escalating adoption of electric vehicles worldwide, spurred by environmental concerns and regulatory initiatives aimed at reducing carbon emissions. Governments and industry stakeholders are incentivizing EV ownership, creating a conducive environment for the growth of the charging card market. Additionally, ongoing advancements in charging infrastructure, such as high-speed charging stations and smart grid technologies, contribute to the market's expansion. The increasing commitment from major automotive manufacturers to electric vehicle production and the rising awareness of the need for clean energy solutions further fuel the demand for EV charging cards. As the market matures, collaborations between governments, businesses, and technology providers continue to play a pivotal role in shaping a robust and interconnected charging network, solidifying the foundation for the sustained growth of the global EV charging card market.

Opportunity:

Evolving Market

The global Electric Vehicle (EV) charging card market presents a myriad of opportunities driven by the burgeoning demand for clean energy solutions and the rapid expansion of electric vehicle infrastructure. One significant opportunity lies in the continued growth of the electric vehicle market itself, as consumers and governments worldwide prioritize sustainable transportation. As the EV landscape evolves, there is immense potential for innovation in charging technologies, creating opportunities for companies to develop faster and more efficient charging solutions. Moreover, the demand for interoperability and seamless user experiences across diverse charging networks creates openings for businesses to offer comprehensive and user-friendly EV charging card services. Collaborations between industry players, technology providers, and governments can further enhance market opportunities by addressing challenges like standardization, accessibility, and cross-border charging. Additionally, the integration of smart technologies, such as mobile applications and data analytics, presents avenues for enhancing user engagement and optimizing charging infrastructure. Overall, the global EV charging card market offers a dynamic landscape for stakeholders to explore and capitalize on the transformative shift towards sustainable and electrified mobility.

| Report Attribute | Details |

| Market Value in 2022 | 75.4 Billion |

| Forecast in 2032 | 306.6 Billion |

| CAGR | CAGR of 29.4% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | E-Flux, Octopus Energy, Shell Recharge, Zap-Map, Bonnet, Elli, BP Pulse, Pod Point, Plugsurfing, Maingau |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355