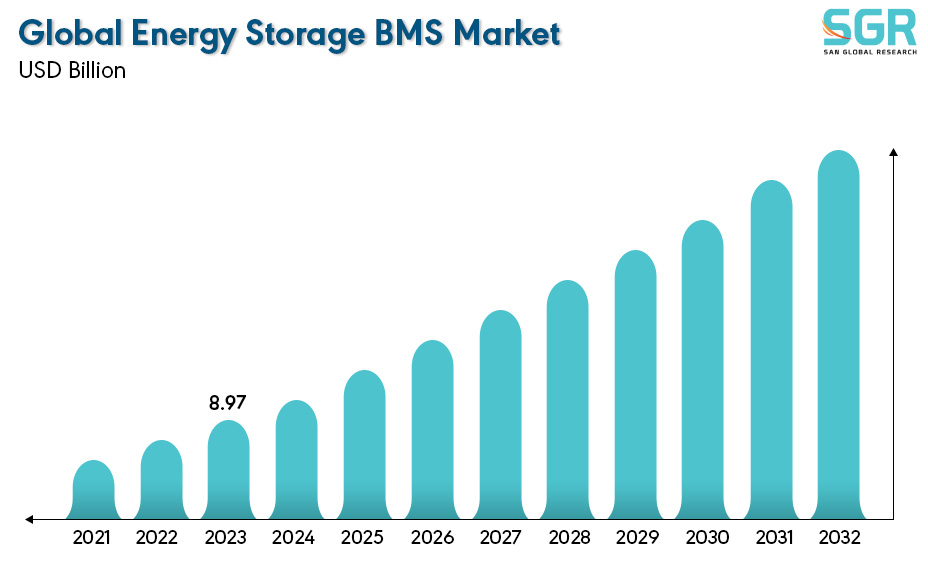

Energy Storage BMS Market is estimated to be worth USD 8.97 Billion in 2023 and is projected to grow at a CAGR of 21 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Type, by Battery Type, by Topology, by Application, and by region/country.

Battery management systems (BMS) are essential for guaranteeing the safety and reliability of batteries. To achieve this, BMS functionalities are constantly being developed. These functions fall into four main categories: real-time monitoring, calculation and prediction, protection, and optimization.

The BMS continuously monitors various battery parameters, including voltage, current, temperature, state of charge (SoC), and state of health (SoH). This data is then used to calculate and predict the SoC, SoH, and internal impedance of the battery. Additionally, the BMS safeguards the battery by limiting overcurrent, overvoltage, and overheating. It can also diagnose potential faults. Finally, the BMS optimizes battery health and performance by maintaining an ideal state of charge and balancing the charge across all cells.

Since batteries degrade with each charging cycle, it's crucial to improve the accuracy of BMS estimations, especially for SoC and SoH. This accuracy directly impacts the overall performance of the BMS. By ensuring precise estimations, the BMS can make better decisions regarding battery protection, optimization, and overall lifespan.

After reviewing the data shown below, it can be determined that the Asia Pacific region dominates the Energy Storage BMS Market for the following reasons.

The Asia Pacific region is poised to lead the Energy Storage Battery Management System (BMS) market. This growth is driven by the surging adoption of electric vehicles (EVs) due to their role in reducing CO2 emissions. Government initiatives in China, the world's largest EV market, further accelerate this growth by promoting EV purchases. As BMS integration is critical for ensuring battery efficiency in EVs, the demand for advanced BMS solutions is on the rise. This includes the proposed electronic BMS, designed to regulate, monitor, and maintain battery health to prevent damage and optimize performance. This focus on well-balanced battery management through innovative BMS design is a key factor propelling the exponential growth of the Energy Storage BMS market.

Europe region is steadily growing the Energy Storage BMS market due to the market for lithium-ion batteries is growing rapidly. Since 2010, lithium-ion battery deployment has skyrocketed by 500%. Once confined to consumer electronics in the 90s and early 2000s, lithium-ion batteries have now taken the leap, powering everything from lawnmowers to ferries. And due to the increasing demand for Uninterrupted Power Supply (UPS), also the demand in Industrial automation which is substantially increasing the Energy Storage BMS market.

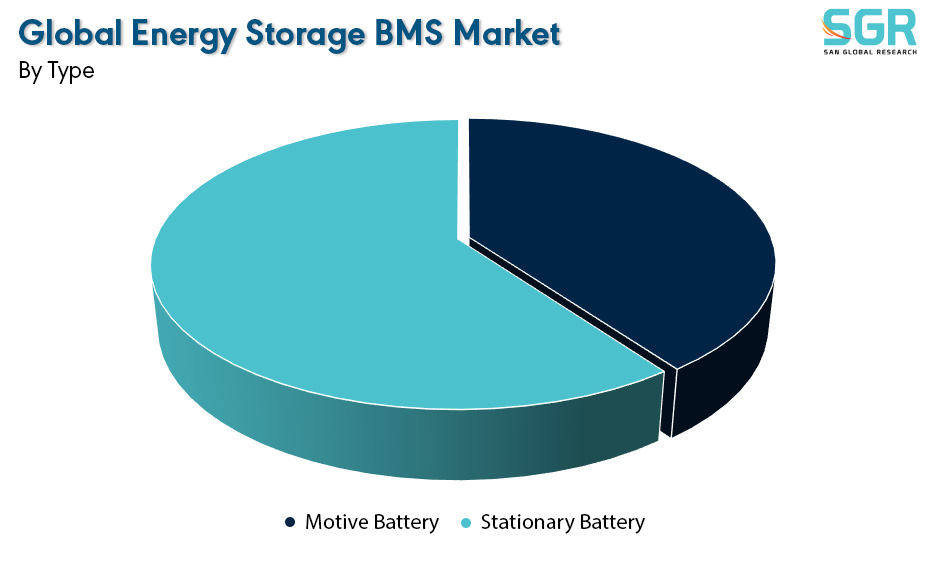

By Type

Based on the Type, the Energy Storage BMS Market is bifurcated by Motive and Stationary– where Stationary Battery is dominating and ahead in terms of share. The stationary battery segment reigns supreme in the Energy Storage Battery Management System (BMS) market due to booming demand across various sectors. This includes Uninterruptible Power Supply (UPS) systems for consistent power, emergency backup power in homes and businesses, off-grid solar power systems for remote locations, data centres requiring reliable operation, and telecommunication systems ensuring uninterrupted connectivity. This extensive growth across these sectors fuels the need for sophisticated BMS solutions specifically tailored for stationary batteries.

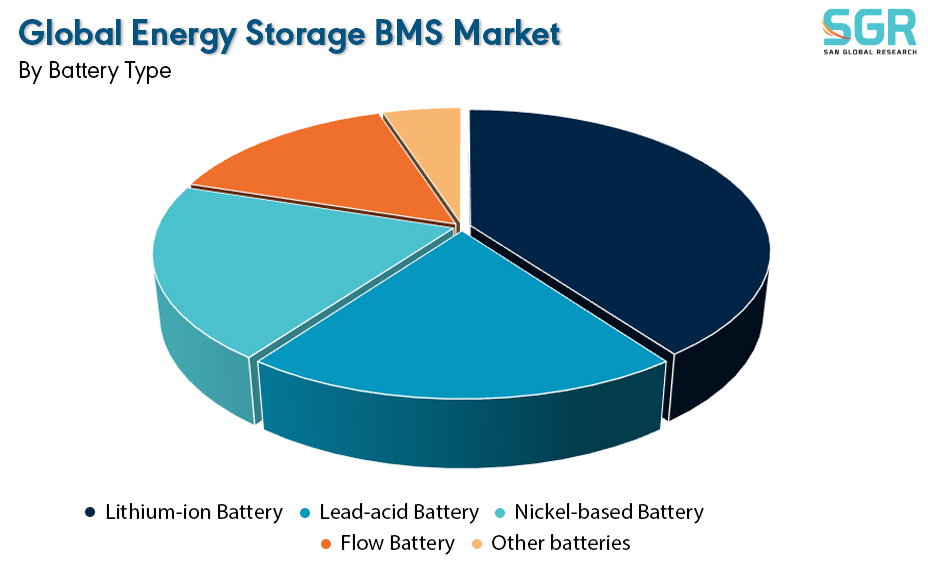

By Battery Type

Based on the Battery Type, the Energy Storage BMS Market is bifurcated by Lithium-ion Battery, Lead-acid Battery, Nickel-based Battery, Flow Battery and Other batteries– where Lithium-ion Battery is dominating and ahead in terms of share. Lithium-ion Battery dominates in the Energy Storage BMS market due to their lightweight nature, due to lithium being the lightest metal, allows for exceptional energy density (over 150 Wh/kg for advanced types) and higher cell voltages (over 3.6V). This translates to fewer cells needed in battery packs, reducing weight and complexity – perfect for applications where size and weight matter. Simply put, they offer more power in a lighter package, making them ideal for demanding energy storage needs, hence their dominance in the BMS market.

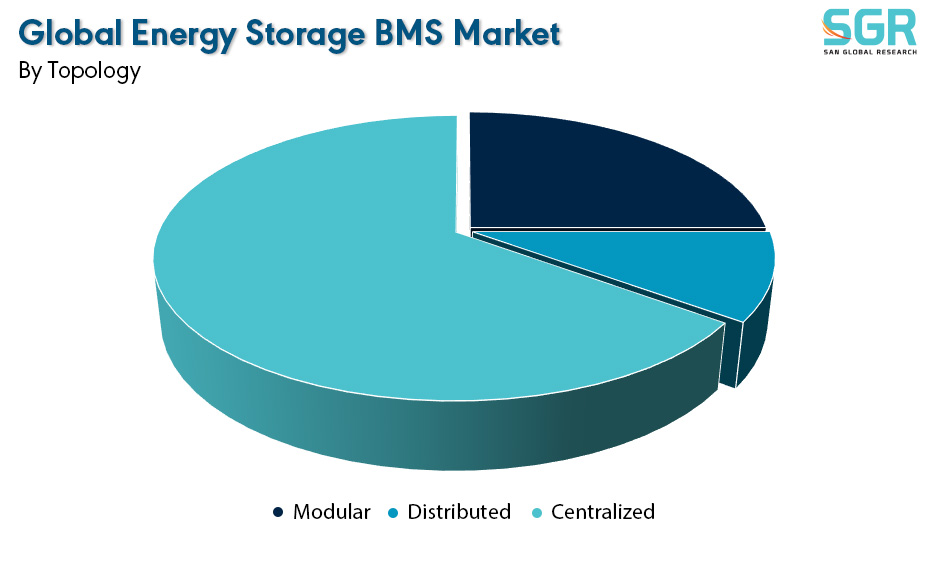

By Topology

Based on the Topology, the Energy Storage BMS Market is bifurcated by Modular, Distributed and Centralized– where is dominating and ahead in terms of share. Due to its cost effectiveness, being suitable for smaller systems to medium sized energy storage systems and being easier to implement. Centralized BMS also has a proven track record of reliability which makes it an easier choice for many applications.

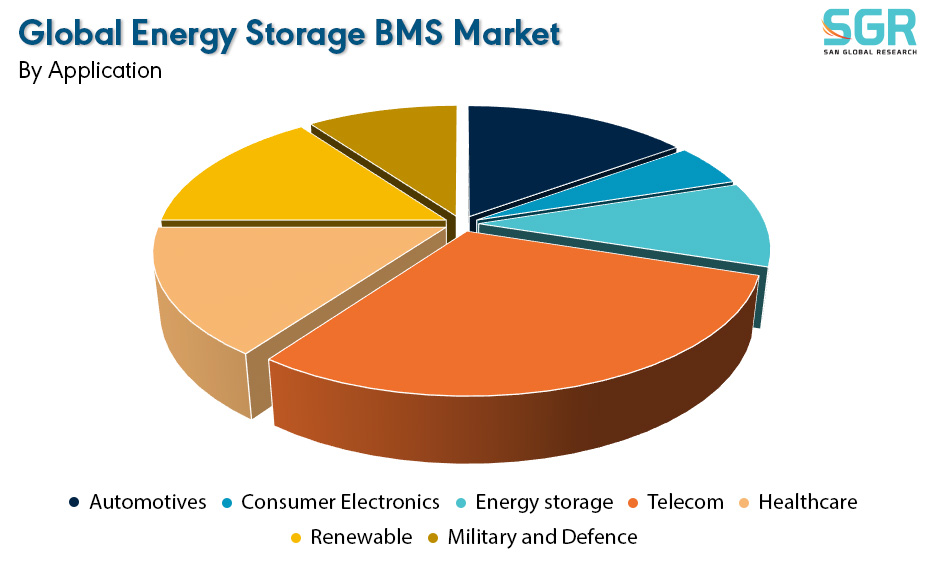

By Application

Based on the Application, the Energy Storage BMS Market is bifurcated by Automotives, Consumer electronics, Energy storage, Telecom, Healthcare, Renewable and Military and Defence– where is Telecommunication is dominating and ahead in terms of share. Modern telecom networks rely on sensitive equipment demanding a consistent power supply, while the increasing integration of variable renewable energy sources challenges grid stability. Energy storage systems with advanced BMS can act as a buffer, storing excess energy during peak generation and releasing it during peak demand or grid instability. Furthermore, advancements in lithium-ion battery technology (high energy density, long lifespan) and BMS optimization algorithms (intelligent control, extended battery life) create a perfect storm for reliable and cost-effective energy storage solutions in the telecommunication sector.

Key Players

• Robert Bosch GmbH

• AVL

• Edition

• Ricardo

• Mastervolt

Drivers

Growth in EVs Adoption and Favorable Government Initiatives

The global surge in electric vehicle (EV) adoption is a key driver for the energy storage BMS market. This is because BMS plays a critical role in ensuring EV battery safety, stability, and optimal performance. By monitoring and controlling various parameters like cell voltage, lifespan, health, and charging/discharging rates, BMS maximizes battery efficiency and longevity. As well as due to the favourable government initiatives. This translates to a significant market boost as the demand for reliable and effective EV battery management solutions rises.

Opportunity

Technological Advancements

The energy storage BMS market is brimming with exciting growth opportunities. Expansion into new applications like microgrids, smart homes, and industrial energy management presents a vast potential customer base. Furthermore, advancements in BMS functionalities like cloud-based analytics, AI-powered optimization, and enhanced cybersecurity will create valuable solutions. Seamless integration with smart grids and a focus on eco-friendly design will further propel the market forward.

| Report Attribute | Details |

| Market Value in 2023 | 8.97 Billion |

| Forecast in 2032 | 49.18 Billion |

| CAGR | CAGR of 21% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Type, By Battery Type, By Topology, By Application |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Robert Bosch GmbH • AVL • Edition • Ricardo • Mastervolt |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355