Report Overview

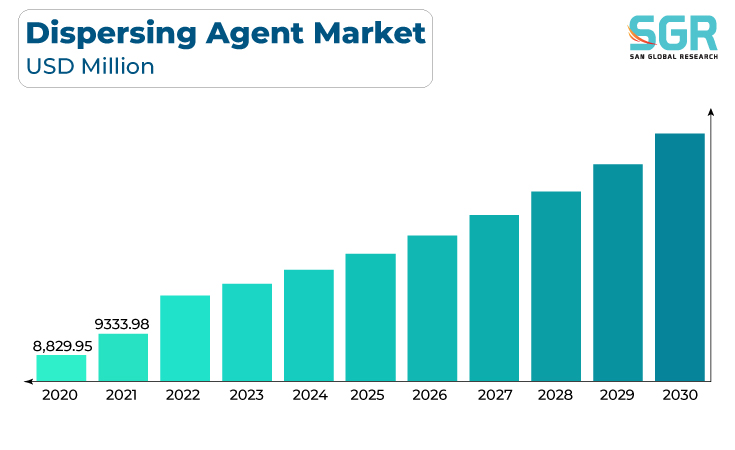

The dispersing agent market was valued at 9,877.50 million in 2022 and expected to grow at CAGR of 7.0% over forecast period.

Growing demand for dispersing agents in the various industries such as pharmaceuticals, construction, food & beverages, oil and gas industry and textile industry are driving the growth for dispersing agent market. The construction sector is a significant consumer of dispersible agents, especially in the production of high-performance concrete and mortar. As construction activity increases globally, the demand for dispersible agents to enhance construction materials' properties, such as workability, durability, and strength.

Moreover, dispersible agents are used in pharmaceutical formulations to enhance the solubility and bioavailability of drugs. Hence, growing demand of dispersible agents in pharmaceutical applications are fueling the growth of dispersing agents’ market.

The food and beverage industry relies on dispersible agents for functions like stabilizing emulsions, suspensions, and improving the texture and sensory characteristics of food products. Thus, growing demand of dispersible agents in food and beverages processing industry is likely to fuel the growth of dispersing agent market.

Application Outlook

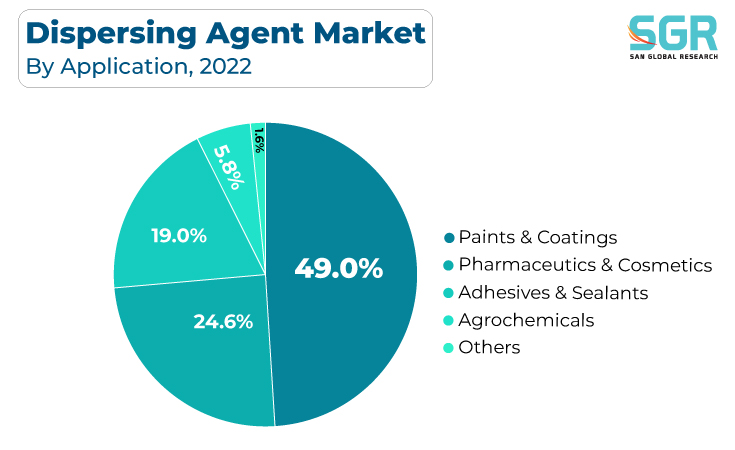

Based on application, the dispersing agent market is segmented into paints and coatings, pharmaceutics and cosmetics, adhesives and sealants, agrochemicals and others. paints and coatings segment accounted for largest share in 2022. Dispersing agents are used in the formulation of paints and coatings to evenly disperse pigments and fillers within the liquid binder. This helps in achieving uniform color, texture, and coating properties. the paints and coatings industry relies heavily on dispersing agents to produce high-quality, stable, and environmentally compliant products. As global demand for paints and coatings continues to grow across various sectors, so does the demand for dispersing agents, making it a key driver of growth in the dispersing agent market. Furthermore, various manufacturers are expanding their product line to fulfill the increased demand of dispersing agents in paints and coating industry are driving the growth of market.

For instance,

In June 2023, Clariant, introduced a line of wetting and dispersing agents that will allow producers of coatings to increase the open time of their acrylic lacquers and polyurethane (PU) lacquers as well as the current post-application correction windows for these water-based systems.

Regional Outlook

Asia-Pacific has emerged as leading market for dispersing agent market in 2022. Several key factors are driving the Asia-Pacific dispersing agent market such as Asia-Pacific region is witnessing rapid urbanization and infrastructure development, leading to a growing construction industry. Dispersing agents are essential in the production of high-quality paints, coatings, and construction materials, which are in high demand for residential, commercial, and infrastructure projects.

Furthermore, the automotive industry in Asia-Pacific is one of the largest and fastest-growing in the world. Dispersing agents are used in the formulation of automotive coatings, adhesives, and sealants, which are crucial for vehicle production. As a result, the Asia-Pacific is driving the growth of dispersing agent market.

For instance,

In 2020, BASF increased its production capacity for advanced additives such as high molecular weight dispersing agents, slip and leveling agents and other at its wholly-owned site in Nanjing, China. The new asset will allow BASF to produce locally for Asian markets.

Dispersing Agent Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 9,877.50 Million |

| Forecast in 2030 | USD 16,826.26 Million |

| CAGR | CAGR of 7.0% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | BASF SE, Dow Inc., Evonik Industries, Clariant International, Elementis plc, Lubrizol Corporation, Arkema Group, Croda International, Solvay S.A., BYK-Chemie GmbH (Altana Group) |

Global Dispersing Agent Market, Report Segmentation

Global Dispersing Agent Market, Report Segmentation

Dispersing Agent Market, By Application

- Paints and coatings

- Pharmaceutics and cosmetics

- Adhesives and sealants

- Agrochemicals

- Others

Dispersing Agent Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355