Report Overview

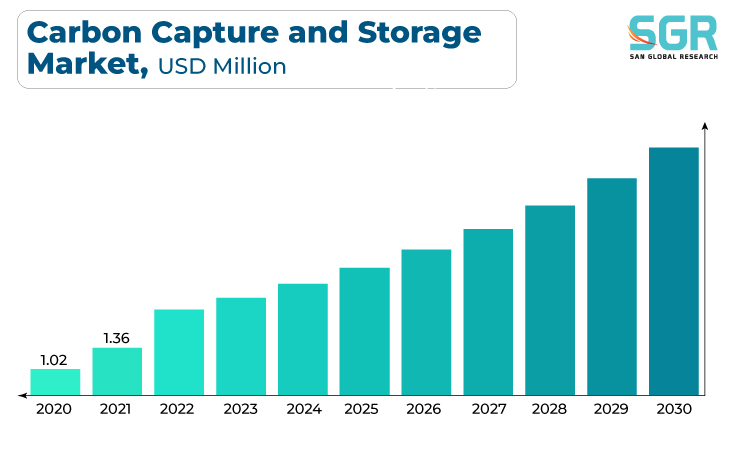

The Carbon Capture and Storage Market was valued at 2.01 billion in 2022 and expected to grow at CAGR of 11.69% over forecast period.

A number of factors are driving the carbon capture market, all with the goal of mitigating climate change and lowering greenhouse gas emissions. Environmental regulations and carbon pricing mechanisms are being implemented by governments around the world, incentivizing industries to adopt carbon capture technologies in order to meet emissions reduction targets and avoid penalties. Furthermore, rising corporate sustainability commitments, investor pressure for ESG (Environmental, Social, and Governance) compliance, and rising public awareness of climate issues are putting pressure on companies to invest in carbon capture solutions as part of their decarbonization strategies.

Furthermore, advancements in carbon capture technologies, coupled with decreasing costs and improved efficiency, are making these solutions more economically viable and attractive to a broader range of industries, fostering market growth and innovation in this crucial field.

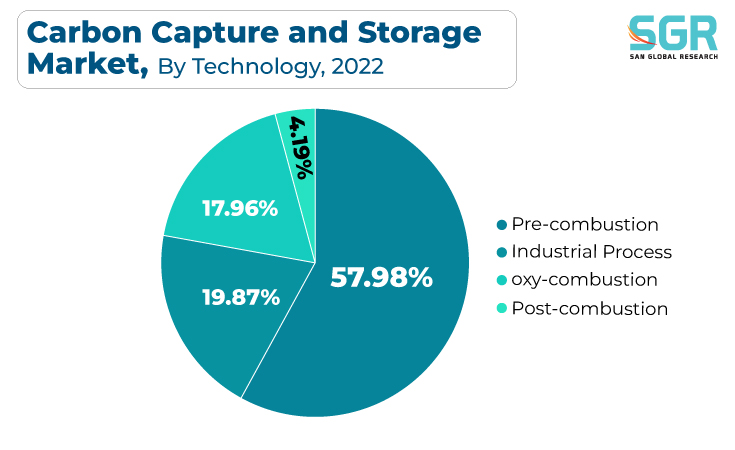

Technology Outlook

Based on Technology, the Carbon Capture and Storage Market is segmented Oxy-Combustion, Pre-combustion, Industrial Process and Post-combustion. Pre-combustion segment accounted for largest share in 2022. The imperative to reduce carbon emissions from industrial processes and power generation while maintaining energy efficiency drives the pre-combustion carbon capture market. This technology is especially useful in industries such as natural gas processing and coal-to-chemicals, where capturing CO2 before combustion is frequently more feasible than post-combustion capture. Stringent emissions reduction targets, carbon pricing mechanisms, and environmental regulations all over the world encourage industries to use pre-combustion carbon capture to meet compliance requirements and avoid financial penalties. Furthermore, as renewable energy sources gain popularity, pre-combustion carbon capture can help reduce emissions from existing fossil fuel-based power plants, bridging the gap to cleaner energy alternatives.

As governments around the world implement stringent emissions reduction targets and carbon pricing mechanisms, industries are becoming more motivated to use oxy-combustion as a viable solution to meet these requirements, avoid penalties, and improve environmental compliance. Furthermore, the market is being fueled by ongoing R&D efforts aimed at improving oxy-combustion efficiency and lowering operational costs, making it a more economically appealing option for carbon capture and storage, particularly in sectors with carbon-intensive processes such as cement, steel, and power generation.

End-User Outlook

Based on End-User, Carbon Capture and Storage Market is segmented into Power Generation, Oil & Gas, Metal Production, Cement and Others. Power Plants accounted for largest share in 2022. The global commitment to reduce greenhouse gas emissions and combat climate change is driving demand for carbon capture in the power generation sector. As governments and international organizations set ambitious carbon reduction targets, power plants, particularly those powered by fossil fuels such as coal and natural gas, are under increasing pressure to implement carbon capture technologies. The power generation sector contributes significantly to global CO2 emissions, and carbon capture provides a way to decarbonize these facilities while meeting energy demands.

Carbon capture in power generation is expected to grow as carbon pricing mechanisms, emissions trading systems, and regulatory incentives become more economically viable for power producers to invest in these technologies. Furthermore, as renewable energy sources expand, carbon capture in the power sector may become even more critical to address emissions from existing fossil fuel-based power plants until cleaner alternatives can fully replace them.

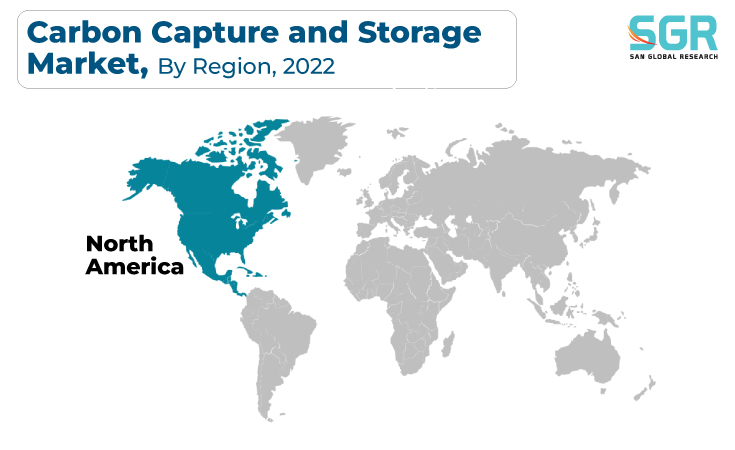

Regional Outlook

North America is emerged as leading market for Carbon Capture and Storage Market in 2022. A combination of regulatory, economic and environmental factors drive the North American carbon capture market. Federal and state government policies, such as carbon pricing mechanisms, emissions reduction targets, and incentives for carbon capture deployment, are driving the growth of this market. Furthermore, the region's commitment to addressing climate change and reducing greenhouse gas emissions, combined with a growing public and corporate focus on sustainability and ESG (Environmental, Social, and Governance) criteria, is putting pressure on industries to invest in carbon capture technologies.

The Asia Pacific Carbon Capture and Storage Market is thriving due to several key factors. As Asia Pacific economies expand, carbon emissions rise, making carbon capture technologies critical for achieving sustainability goals and meeting international climate commitments. To address these environmental challenges, governments in the region are gradually implementing regulatory measures, carbon pricing mechanisms, and emission reduction targets. Furthermore, many Asia Pacific countries' energy mix still heavily relies on coal and other fossil fuels, making carbon capture a critical component in reducing emissions from power generation. Furthermore, as corporate sustainability initiatives gain traction and global supply chains seek cleaner practices, demand for carbon capture solutions in sectors such as cement, steel, and petrochemicals is expected to rise. As a result of this complex interplay of industrial expansion, environmental concerns, and regulatory imperatives, the Asia Pacific carbon capture market is poised for significant growth.

Carbon Capture and Storage Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 2.01 Billion |

| Forecast in 2030 | USD 6.34 Billion |

| CAGR | CAGR of 11.69% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Technology, By End-Use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Dakota Gasification Company, Equinor ASA, Fluor Corp., Linde plc, Maersk Oil, Mitsubishi Heavy Industries Ltd., Royal Dutch Shell PLC, Siemens AG, Sulzer Ltd. |

Carbon Capture and Storage Market Report Scope

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

- Pre-combustion

- Industrial Process

- Oxy-combustion

- Post-combustion

End User Outlook (Revenue, USD Billion, 2018 - 2030)

- Oil and Gas

- Coal and Biomass

- Power Plants

- Iron and Steel

- Chemical Manufacturing

Carbon Capture and Storage Market , Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355