Report Overview

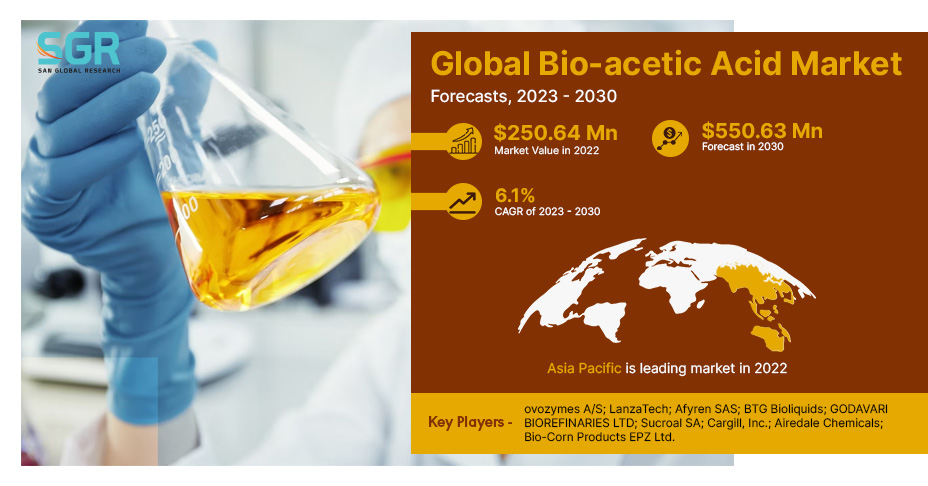

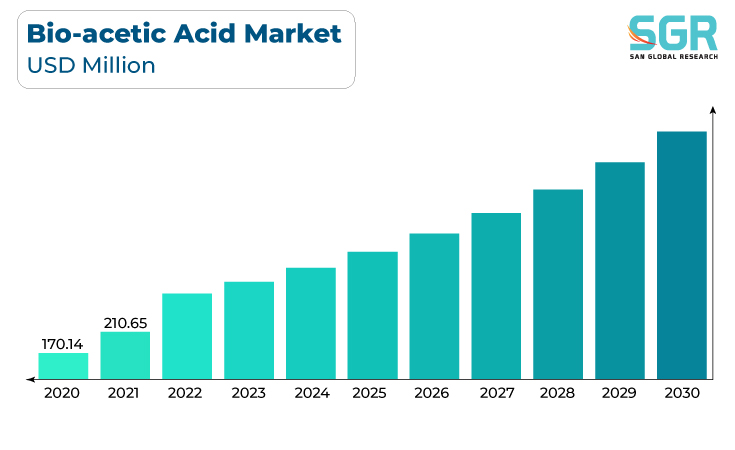

The Bio-acetic Acid Market was valued at 250.64 million in 2022 and expected to grow at CAGR of 6.1% over forecast period.

Growing environmental concerns, as well as a growing awareness of the need for sustainable alternatives to petrochemical-derived acetic acid, have resulted in an increase in demand for bio-based acetic acid, which is made from renewable feedstocks such as biomass and agricultural residues. Second, stringent regulations and policies aimed at reducing carbon emissions and encouraging the use of bio-based products have created a favorable regulatory environment for the adoption of bio-acetic acid.

The expansion of industries such as food and beverages, textiles, and pharmaceuticals, all of which rely heavily on acetic acid as a key raw material, has fueled market growth even further. As a result, the bio-acetic acid market is expected to grow further as it aligns with both environmental sustainability goals and industrial demands.

Application Outlook

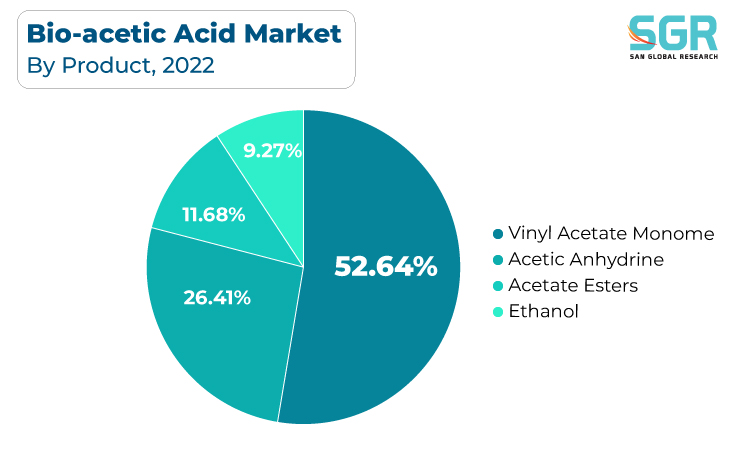

Based on Application, the Bio-acetic Acid Market is Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Ethanol. Vinyl Acetate Monomer (VAM) segment accounted for largest share in 2022. Several key factors drive the market for Vinyl Acetate Monomer (VAM) and Bio-acetic Acid. For starters, increased environmental awareness and commitment have increased demand for bio-based and renewable chemicals in a variety of industries, including the production of VAM and Bio-acetic Acid. A significant driver is the shift away from fossil fuels and petroleum-based feedstocks and toward bio-based alternatives. Furthermore, strict environmental regulations and government initiatives aimed at reducing carbon emissions and promoting sustainable practices have encouraged the use of bio-acetic acid as a key raw material in the production of VAM. Furthermore, the growing use of VAM and Bio-acetic Acid in industries such as adhesives, paints, coatings, and textiles has fueled market growth as companies seek environmentally friendly and sustainable solutions.

The growing emphasis on sustainability, as well as the need to reduce the environmental impact of chemical processes, has resulted in an increase in demand for bio-based acetic acid, which serves as a sustainable alternative to traditional, fossil-fuel-derived acetic anhydride. Environmental regulations and carbon reduction commitments are driving the use of bio-acetic acid in the production of acetic anhydride even further.

Regional Outlook

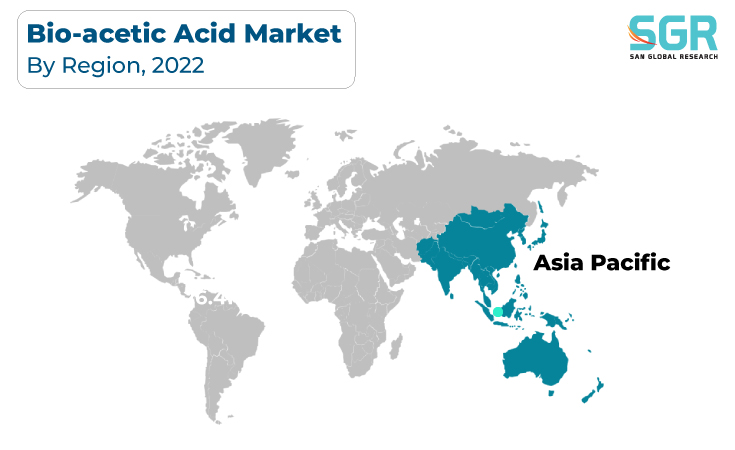

Asia Pacific is emerged as leading market for Bio-acetic Acid Market in 2022. Several key factors are driving the Asia Pacific bio-acetic acid market. To begin, growing awareness and concern about environmental sustainability has prompted a shift toward bio-based and renewable chemicals, such as bio-acetic acid, which is derived from renewable feedstock sources such as biomass and agricultural residues, thereby lowering the carbon footprint. Furthermore, rising demand for bio-acetic acid in industries such as food and beverages, pharmaceuticals, and textiles, fueled by its eco-friendly properties and diverse applications, is propelling market growth. Furthermore, government initiatives and policies encouraging the development and adoption of bio-based chemicals, as well as investments in research and development to improve production processes and cost-effectiveness, are propelling the Asia Pacific bio-acetic acid market forward.

The bio-acetic acid market in North America is expanding rapidly due to several key factors. There is a growing emphasis on sustainability and reducing environmental impact, which is leading to an increase in the use of bio-based chemicals such as bio-acetic acid, which is derived from renewable sources such as biomass, agricultural waste, and organic materials. Furthermore, due to its eco-friendliness and versatility as an ingredient, demand for bio-acetic acid is increasing in a variety of industries, including pharmaceuticals, food and beverages, and cosmetics. Government regulations encouraging the use of bio-based chemicals, as well as investments in research and development to improve manufacturing processes, are fueling the growth of the bio-acetic acid market in North America.

Bio-acetic Acid Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 250.64 Million |

| Forecast in 2030 | USD 550.63 Million |

| CAGR | CAGR of 5.9% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Novozymes A/S; LanzaTech; Afyren SAS; BTG Bioliquids; GODAVARI BIOREFINARIES LTD; Sucroal SA; Cargill, Inc.; Airedale Chemicals; Bio-Corn Products EPZ Ltd. |

Global Bio-acetic Acid Market, Report Segmentation

Bio-acetic Acid Market, By Application

- Vinyl Acetate Monome

- Acetic Anhydride

- Acetate Esters

- Ethanol

Bio-acetic Acid Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355