Report Overview

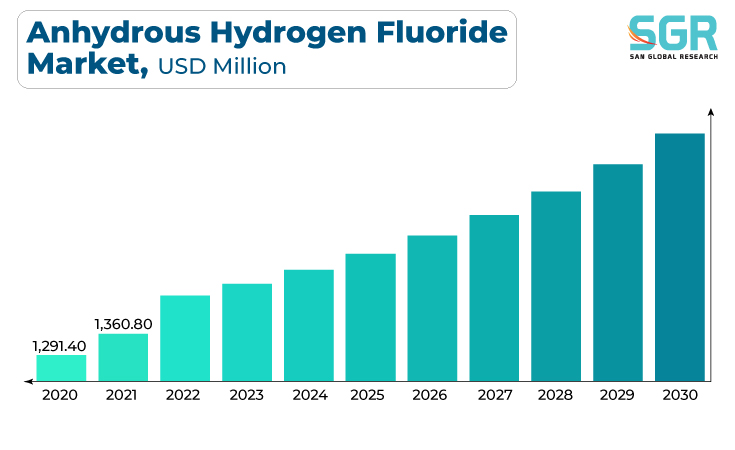

The anhydrous hydrogen fluoride Market was valued at 1,449.25 million in 2022 and expected to grow at CAGR of 7.1% over forecast period.

Growing demand for Anhydrous Hydrogen Fluoride (AHF) in the production of fluorinated chemicals as AHF is crucial raw material for various industrial applications such as pharmaceuticals, electronics, and automotive. Thus, growing applications of fluorinated chemicals are fueling the growth of anhydrous hydrogen fluoride market. Moreover, advancements in AHF production technologies and purification methods can reduce costs and improve the overall efficiency of the anhydrous hydrogen fluoride market. These advancements can make AHF more accessible to a broader range of industries.

Anhydrous hydrogen fluoride is a key ingredient in the production of high-performance fluorinated polymers, which have applications in aerospace, automotive, and chemical industries. As a result, the anhydrous hydrogen fluoride market is expected to grow further as it aligns with both environmental sustainability goals and industrial demands.

End Use Outlook

Based on End use, the anhydrous hydrogen fluoride market is segmented into fluoropolymers, fluorogases, pesticides and others. Fluorogases segment accounted for largest share in 2022. Several key factors drive the market for fluorogases includes the transition from ozone-depleting refrigerants like CFCs and HCFCs to more environmentally friendly alternatives like hydrofluorocarbons (HFCs) and hydrofluoroolefins (HFOs) which has been driven by global environmental regulations like the Montreal Protocol and Kyoto Protocol, as a result demand for fluorogases in automotive, electronics and semiconductor industries are increasing. Hence, increase demand of anhydrous hydrogen fluoride by such industries are fueling the growth of market these days. Furthermore, various manufacturers are expanding their presence to fulfill the increased demand of AHF are driving the growth of market.

For instance,

In 2020, Arkema announces an innovative partnership in the United States for the supply of anhydrous hydrogen fluoride, as a main raw material for production of fluoropolymers and fluorogases. Such type of partnership is likely to drive the growth of the segment in years to come.

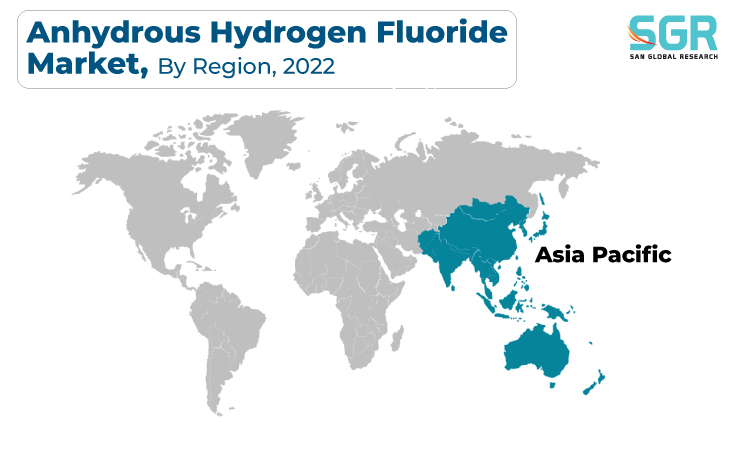

Regional Outlook

Asia-Pacific has emerged as leading market for anhydrous hydrogen fluoride market in 2022. Several key factors are driving the Asia-Pacific anhydrous hydrogen fluoride market such as Asia-Pacific is home to some of the world's largest electronics and semiconductor manufacturing hubs, including Taiwan, South Korea, Japan, and China. AHF is a critical chemical used in semiconductor fabrication processes, such as wafer etching, cleaning, and refrigeration. Moreover, the growth of the electronics industry in the region significantly drives the demand for AHF.

The anhydrous hydrogen fluoride market in North America is expanding rapidly due to several key factors. In North America, particularly the United States, has a strong semiconductor industry. The ongoing expansion of semiconductor manufacturing facilities and the development of advanced technologies often require increased AHF consumption.

For instance,

In 2021, U.S. semiconductor companies continue to invest roughly one-fifth of annual revenue in R&D, amounting to a record $50.2 billion. Such type of investment will help in expanding North America semiconductors market, which will result in providing lucrative opportunities to anhydrous hydrogen fluoride market in North America.

Anhydrous Hydrogen Fluoride Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 1,449.25 Million |

| Forecast in 2030 | USD 2,499.48 Million |

| CAGR | CAGR of 7.1% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By End Use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Honeywell International Inc., Solvay, Mexichem UK Limited, DAIKIN INDUSTRIES, Ltd., Navin Fluorine International Ltd. , Shandong Dongyue Chemical Limited , Luoyang Fengrui Fluorine Industry Co., Ltd., The Linde Group , Arkema and LANXESS |

Global Anhydrous Hydrogen Fluoride Market, Report Segmentation

Anhydrous Hydrogen Fluoride Market, By End Use

- Fluorogases

- Fluoropolymers

- Pesticides

- Other

Anhydrous Hydrogen Fluoride Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355