Report Overview

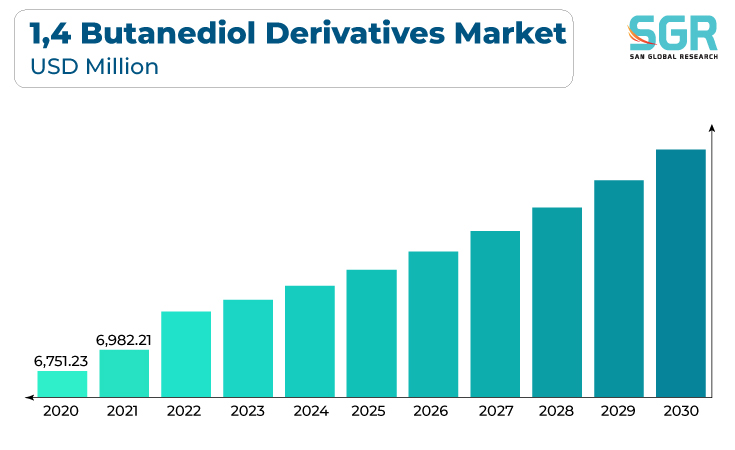

The 1,4 butanediol derivatives market was valued at 7,228.48 million in 2022 and expected to grow at CAGR of 4.1% over forecast period.

1,4 butanediol derivatives, such as polybutylene terephthalate (PBT) and thermoplastic polyurethanes (TPUs), are widely used in the plastics and polymer industry. These materials are used in the manufacturing of automotive parts, electrical components, packaging materials, and more. The growth of industries that rely on these polymers, such as automotive and electronics, drives the demand for 1,4 butanediol derivatives.

Furthermore, 1,4 butanediol derivatives serve as solvents and chemical intermediates in various chemical processes. They are used in the production of coatings, adhesives, sealants, and specialty chemicals. The chemical industry's need for these materials contributes to the demand for 1,4 butanediol derivatives.

The automotive sector relies on 1,4 butanediol derivatives for producing materials with improved strength, durability, and flexibility. As the automotive industry grows, the demand for 1,4 butanediol derivatives rises.

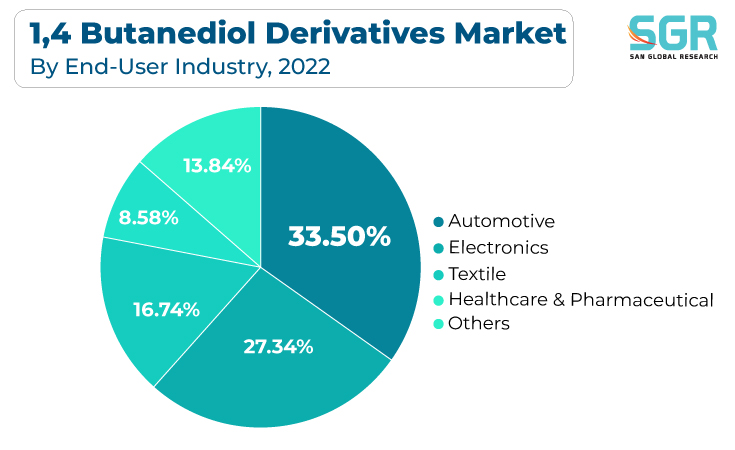

End-User Industry Outlook

Based on end-user industry, the 1,4 butanediol derivatives market is segmented into automotive, healthcare and pharmaceutical, textile, electronics, and others. Automotive segment accounted for largest share in 2022. 1,4 butanediol derivatives are essential in the production of engineering plastics like polybutylene terephthalate (PBT) and polytetramethylene ether glycol (PTMEG). These plastics are used in various automotive components, including interior parts, under-the-hood components, and exterior trim. The demand for lightweight, durable, and high-performance materials in the automotive industry drives the need for 1,4 butanediol derivatives.

Furthermore, TPUs are another class of materials derived from 1,4 butanediol. They offer excellent mechanical properties, resilience, and flexibility. TPUs find extensive use in automotive applications, such as gaskets, seals, hoses, and vibration-damping components, which drives the growth of 1,4 butanediol derivatives market.

Thus, the automotive industry's constant pursuit of innovation, safety, and environmental sustainability has led to an increased demand for advanced materials, including those derived from 1,4-Butanediol. As the automotive industry continues to evolve, so too will its reliance on 1,4 butanediol derivatives to meet the demands of modern vehicle manufacturing and technology. This dependence on 1,4 butanediol derivatives contributes significantly to the growth of the market.

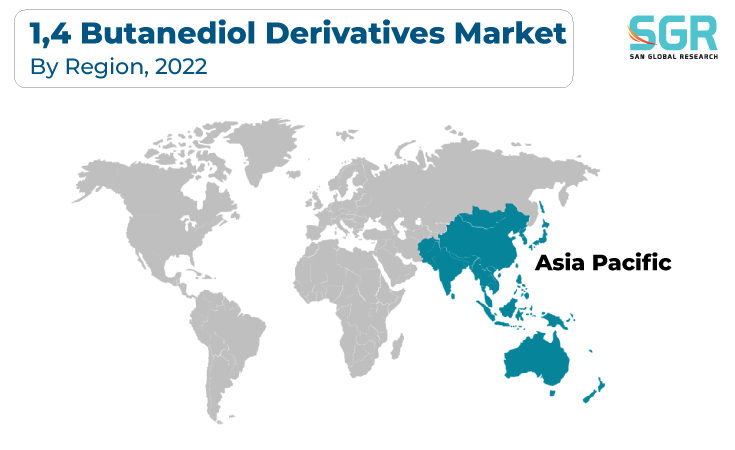

Regional Outlook

Asia-Pacific has emerged as leading market for 1,4 butanediol derivatives market in 2022. Several key factors are driving the Asia-Pacific 1,4 butanediol derivatives market such as the Asia-Pacific, particularly countries like China, India, Japan, and South Korea, has experienced rapid industrialization and economic growth over the past few decades. This growth has led to increased demand for a wide range of products that use 1,4 butanediol derivatives, including plastics, textiles, and chemicals.

Furthermore, Asia-Pacific has become a global manufacturing hub for various industries, including automotive, electronics, and consumer goods. These industries rely on 1,4 butanediol derivatives for materials such as engineering plastics, thermoplastic polyurethanes (TPUs), and specialty chemicals. Hence, growing demand from these industries are driving the growth of Asia-pacific 1,4 butanediol derivatives market.

1,4 Butanediol Derivatives Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 7,228.48 Million |

| Forecast in 2030 | USD 9,934.24 Million |

| CAGR | CAGR of 4.1% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By End-User Industry, By Derivates |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | BASF SE, Dairen chemical corporation, LyondellBasell Industries, Mitsubishi Chemical Corporation, Ashland, Global Holdings Inc., KH Neochem Co., Ltd., Evonik Industries AG, and Sipchem Company among others |

Global 1,4 Butanediol Derivatives Market, Report Segmentation

1,4 Butanediol Derivatives Market, By Derivatives

- Tetrahydrofuran (THF)

- Polybutylene Terephthalate (PBT)

- Gamma-Butyrolactone (GBL)

- Polyurethane (PU)

- Other Derivatives

1,4 Butanediol Derivatives Market, By End-User Industry

- Automotive

- Healthcare and Pharmaceutical

- Textile

- Electronics

- Others

1,4 Butanediol Derivatives Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355